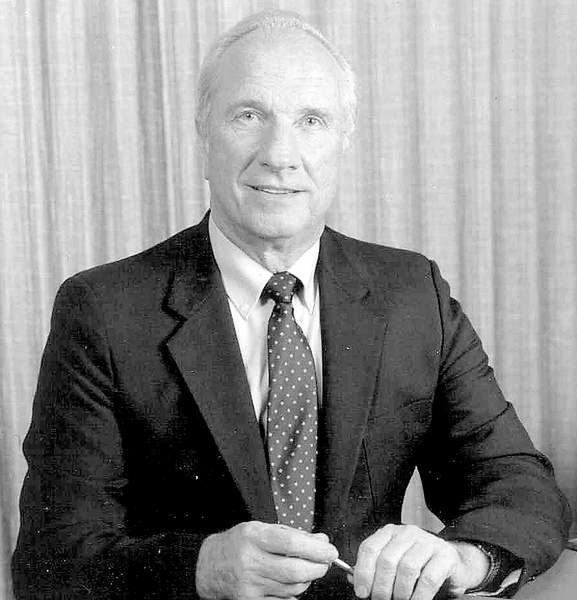

Edgar Callahan, former U.S. credit union chief

Published 5:00 am Wednesday, April 8, 2009

- Edgar Callahan, seen here in 1990, was director of the Illinois Division of Financial Institutions in 1981 when President Ronald Reagan named him to lead the National Credit Union Administration.

Edgar Callahan, who as chairman of the National Credit Union Administration under President Ronald Reagan brought stability to the credit union industry at a time of economic uncertainty, died March 18 at his home in Sacramento, Calif. He was 80.

The cause was complications of an infection after a blood transfusion, said Anita Macias, spokeswoman for the Patelco Credit Union in San Francisco. After his government service, Callahan was president of Patelco until his retirement in 2001.

Trending

Callahan was director of the Illinois Division of Financial Institutions in 1981 when Reagan named him to lead the National Credit Union Administration. The agency regulates the industry and administers the National Credit Union Share Insurance Fund, the equivalent of the Federal Deposit Insurance Corp.

Credit unions provide a range of financial services to members, usually drawn from a particular affiliation, like the employees of a company or a labor union or members of a community group. There are approximately 8,000 credit unions in the country, with more than 92 million members.

The country was in recession when Callahan was appointed, and some credit unions were becoming insolvent just as many of their members needed their services.

“Ed Callahan largely shaped the credit union system as we now know it,” Daniel Mica, president of the industry’s largest trade group, the Credit Union National Association, said on Monday.

“Ed Callahan knew that we had to have solid, stable institutions,” Mica said. “He knew we needed proper capitalization of the insurance fund, and he tried to minimize unnecessary regulations.”

Callahan successfully promoted legislation that, starting in 1985, required credit unions to capitalize the insurance fund with an additional 1 percent of their insured shares, raising the fund’s equity level to 1.3 percent from 0.30 percent and placing it on a far more secure footing.

Trending

Three years after leaving the Reagan administration, Callahan became president of Patelco. At the time, the credit union had $280 million in assets; when he retired it had $2.8 billion.