Credit unions crowd banks

Published 4:00 am Monday, March 13, 2006

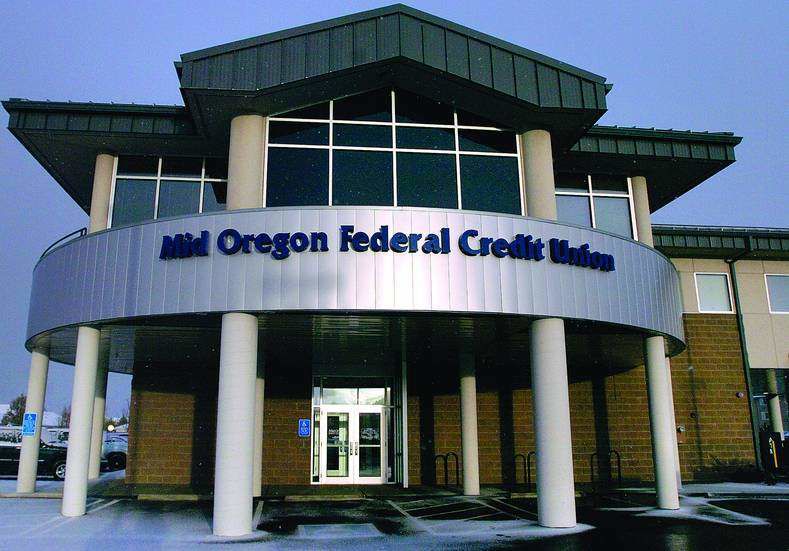

- Mid Oregon Federal Credit Union in Bend is one of many credit unions carving out shares of the Central Oregon market.

As Central Oregon’s fast growth continues to attract new banks to the fray, other financial service providers are quietly carving out their share of the lucrative market.

Credit unions, nonprofit organizations that are owned by their members, are increasingly competing with banks for deposits and loan services around the nation. The case is no different in Central Oregon, with five credit unions, two headquartered in the region, having a growing presence in the local market.

Trending

Bend-based Mid Oregon Credit Union, for instance, is scheduled to open a new branch in Prineville this month.

”We have more than 700 members in Crook County,” said Kyle Frick, Mid Oregon’s vice president of marketing and sales. ”We try to open branches in relation to where our members are.”

But the increasing competition between credit unions and banks is causing some tensions between the two.

Credit unions operate as a co-operative; its members, or account holders, own the organization and can hold officials more accountable to their actions. Being nonprofit, credit unions also are exempt from some taxes and therefore can offer better interest rates to members on loans.

Otherwise, credit unions are similar to banks. They offer similar products, like checking and savings accounts.

The appeal of Central Oregon to credit unions is obvious. The real estate boom and the large influx of outside capital – the reasons why many banks are jumping into the market – also are attracting credit unions looking to add members.

Trending

”It’s a growing market that has a pretty stable economic base,” said Glenda Hart, vice president of marketing for Grants Pass-based SOFCU Credit Union, which has a branch in Bend. ”People recognize that a bigger market will need more financial services, and with more financial institutions, that growing need can be covered.”

Some credit unions are now reaping the rewards. Mid Oregon’s Frick said his organization grew by 12 percent in loans and 10 percent in deposits last year, and now has approximately $96 million in total assets. He added that Mid Oregon likely will add another branch in Deschutes County next year.

Springfield-based Northwest Community Credit Union is adding about 100 new member households a month in Central Oregon, according to spokeswoman Sheryl Williams. The credit union opened a branch in Redmond last year, in addition to its older branch in Bend.

”It’s important to have a branch in Redmond,” Williams said. ”Otherwise, members north of Bend would have to drive south to get to a branch. This way, we hope to better serve members in Redmond and Sisters, and hopefully some from Madras as well.”

Williams added that her organization also is actively looking at another location in Central Oregon.

The growth of credit unions, however, isn’t a popular topic with banks.

The main contention from banks regarding credit unions is the latter’s status as nonprofit organizations. As such, credit unions have tax-exempt status and do not have to pay state or federal taxes. But they do pay property taxes.

Banks pay all three taxes.

As credit unions expand into areas traditionally handled by banks, such as business loans, some banks say the tax exemptions give credit unions an unfair advantage.

Ryan Killgore, U.S. Bank’s regional president for Central Oregon, said credit unions were originally given nonprofit status because they offered financial services to people who would not have had access to them otherwise. Traditionally, members share a common bond, such as being in the same occupation.

”I haven’t seen too many people getting turned away (by credit unions),” Killgore said, pointing to credit unions’ increasing expansion into community charters that allow them to serve a wider part of the community and act more like banks.

”Now, big credit unions are acquiring small credit unions, just like banks,” he added. ”The fundamental question the communities need to ask themselves is: Does it still make sense to offer tax exemptions?”

Other banks, including Bend-based Bank of the Cascades, declined to comment.

Kenneth Bell, CEO of Prineville-based Ochoco Federal Credit Union, said banks should not worry.

”If you take all the assets from all the credit unions in the country and add it up, it comes out equal to the assets of Bank of America,” Bell said. ”That’s one bank. It’s like David versus Goliath, except David doesn’t have a sling.”

Bell added that the real party being threatened by credit unions is smaller credit unions such as Ochoco, which has roughly $10 million in total assets.

”I think the credit union movement is undergoing lots of changes,” he said. ”The trend is to have fewer and larger credit unions because, with the economy of scale, bigger credit unions can compete better with banks. It’s more and more difficult for small credit unions to compete.”

But there is hope, Bell said.

”We can’t be everything to everyone; you have to find a niche that’s not being fulfilled in your market,” he said, pointing out that small credit unions in Burns and John Day have focused on agricultural lending. ”If small credit unions can find a niche and be successful with that, they’ll always be here.”