Real estate outlook: slower, but healthy

Published 4:00 am Wednesday, February 28, 2007

- Real estate outlook: slower, but healthy

Want to make money in local real estate this year?

This is what three prognosticators say you should do:

Trending

* Sell industrial land in Bend. Buy it in Redmond.

* Build apartments in Bend.

* Buy in downtown Redmond. And think condos and downsized housing in Bend.

The easy money of the housing market boom is gone, but plenty of opportunities still exist, Compass Commercial Real Estate Services broker Darren Powderly, Bratton Appraisal Group President Dana Bratton and Becky Breeze and Co. principal real estate broker Becky Breeze told a sold-out Bend Chamber of Commerce crowd Tuesday morning.

Particularly if they’re opportunities that might appeal to a well-heeled baby boomer. Or to a transplanted entrepreneur.

”You’re not going to make money in your sleep in 2007, unfortunately,” Powderly said, evoking memories of the boom months of 2005 and early 2006. ”Those were good times. Those were very good times. But this year you’re going to have to get more creative.”

Trending

About 650 people – a full house of mostly real estate brokers, bankers, developers, contractors and construction suppliers – turned out for the chamber’s annual Real Estate Forecast Breakfast in the new Riverhouse Convention Center.

One factor seemed to hang over the hall: the deadening of Bend’s and Redmond’s housing booms.

Fueled by a ”perfect storm” of low mortgage rates, the bursting of the stock market bubble and the relative unattractiveness of bonds and bank interest, housing became the darling of the investment world in 2005, Bratton noted, and Bend, in particular, rapidly overbuilt itself in response.

In a city that can absorb around 1,500 new homes a year through population growth, contractors took out nearly 2,000 building permits in 2005, Bratton noted, then started the first half of 2006 on a similar pace.

Sales ramped down rapidly in July after investors pulled out of the market, and the pace of construction slid with them, dropping to about 400 over the last half of the year.

Median prices have moderated, too, Bratton noted, falling from $380,500 on Bend sales that closed in September to $323,659 in January, and in Redmond falling from $274,989 on September sales to $248,495 in January.

The inventory of unsold homes in Bend, meanwhile, has dropped from 1,723 in July to 1,498 this month, Bratton said. February sales are picking up in Bend and around the region, according to Breeze’s numbers, with 644 Bend homes either closed or entering escrow in the first 52 days of the year and 1,132 sold or pending regionwide with 3,146 left to sell.

The bottom line? There’s still a demand for Central Oregon housing, Bratton said, but the market will have to shed its excess inventory before it stabilizes.

”I think we’re in a healthy market,” Bratton said. ”It feels like where we ought to be. There’s a few excess homes. And the cure for those excess homes is going to be time. We’re going to absorb them. We’re going to be fine.”

Other segments of the regional real estate market hold pockets of opportunity, Powderly said.

Compass’ quarterly surveys show that vacancy rates on industrial land in Bend have fallen from 5.9 percent to 3.2 percent in the last five years. In Redmond, they’ve dropped from 8.6 percent to 6.9 percent.

Office space is growing tight, too, Powderly said, with Bend vacancy rates dropping from 11.8 percent to 6.5 percent over a five-year span.

Lease rates are rising in commercial buildings as tenants renegotiate leases signed five years ago in a new, landlord-friendly environment, Powderly said.

New buildings are going up to accommodate the demand, and land prices have risen to reflect it, too.

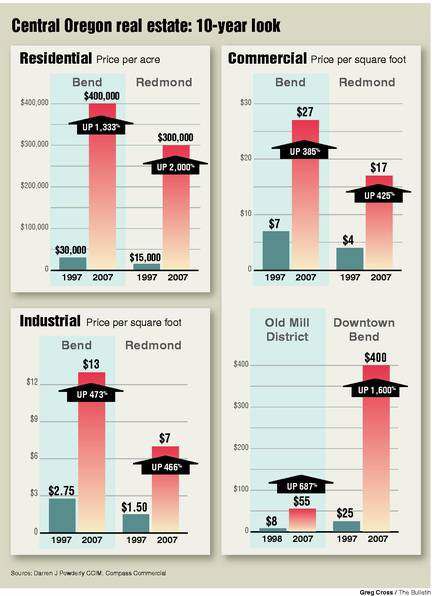

Land prices have reached $400 per square foot in downtown Bend, according to Compass’ numbers. They’re not nearly as eye-popping in other locales, but they’re still high enough to put pressure on buyers to sharpen their numbers before they leap in.

Commercial land prices in Bend as a whole are running about $27 per square foot, Powderly said. In Redmond, they’re $17 per foot. The price of industrial land in Bend, where the supply of land is tight, has reached $13 per square foot. In Redmond, where the supply is looser, it’s $7 per square foot.

What it all means

So what does that boil down to, from an investor’s perspective?

It’s time to sell industrial land in Bend to lock in the profits, Powderly said, or time to develop it to capitalize on demand that is still expected to be tight, despite a general slowdown in expansion plans for construction-related businesses. Redmond, with a price that’s half of Bend’s, might be worth a closer look.

Some properties in downtown Bend might be in for a price correction, he said. But downtown Redmond, with the prospect of redevelopment at hand when U.S. Highway 97 traffic is routed away from it, is a buy.

Office building owners will likely be able to command 12 percent to 15 percent rent increases, depending on location and quality, Powderly said, as vacancy rates plug along at about 6 percent.

Retail growth is likely to be strong in Redmond, with big-box retailers, including Wal-Mart and The Home Depot, coming to town, Powderly said. In Bend, south Third Street is poised for redevelopment, and Trader Joe’s, the popular grocer, has committed to coming to the Cascade Village Shopping Center.

In-migration, Powderly said, has driven all of Central Oregon’s markets upward over the last 10 years.

The region’s appeal to mid- career entrepreneurs and young retirees is likely to continue, Powderly and Breeze said, driven by favorable national and international media coverage and by a quality of life that will continue to pull people away from overcrowded cities.

And then there’s the broader nation’s demographics.

‘Baby boom tsunami’

In the long term, investors in the local housing market might want to think about building or buying the kinds of properties that healthy retirees are going to demand, Bratton said. Low-maintenance condos and townhomes close to the downtown core, lofts, rooftop housing – ”look for the opportunity to meet the needs of people who want to live, work and play in the same neighborhood.

”I believe we are seeing a new phenomenon occur,” Bratton said. ”The baby boom population tsunami is about to splash up on retirement beach.”

That may be true, one of the region’s real estate bears said later in the day, but what happens to the region’s broader housing market while it waits for the wave is still a point open to debate.

Bratton said he thinks the slump in the local housing market is almost over.

”The word in the real estate houses is the phones are ringing, people are looking at property and we are coming back, back on the bounce,” he told the chamber crowd.

Bend money manager Bill Valentine, on the other hand, sees some darker times ahead.

Valentine, who tried, but failed, to sell his house last summer in a well-publicized attempt to lock in his gains, said the region may experience a flat or slightly rising sales environment this year, supported by low interest rates. But a tick or two upward in the interest rates could let considerably more air out of the housing market here and nationwide if stressed mortgage holders are forced to sell.

”I think the long-term trend for Bend is as good as it is any place in the world,” Valentine said. ”It’s just that we have a short-term correction to work out.”