Area home sales are leveling off

Published 5:00 am Wednesday, March 14, 2007

- Area home sales are leveling off

Home sales and construction starts are off their peaks this spring in Central Oregon, but Mark Stevens says he isn’t worried.

His nine masonry crews – 20 employees in all – are finding plenty of work throughout the region, and he doesn’t see the pace slipping much this year.

”I don’t know if it’s really cooled. Just kind of leveled,” said Stevens, the Eastern Oregon construction supervisor for Portland’s David Schuler Masonry Inc., as he laid cinder blocks for the columns in front a new house just off Bend’s Brookswood Boulevard. ”This is a hot place to live.”

In the subcontractor world, Stevens may be one of the lucky ones.

Central Oregon home sales have reached what might be considered seasonal norms so far this year, raising hopes for steady movement when the traditional sales season gets under way in March and April.

Still, after the abrupt deceleration of late summer and fall last year, builders say they are taking fewer chances this spring, launching fewer housing starts until they see where the market is going.

And that, some market observers say, might be a good thing.

”It appears we have lost the investor class, but we’ve moved into a nice, stable, fundamental market,” Bratton Appraisal Group appraiser Mike Caba said. ”It’s not the crazy, overheated market that we did have, but it’s a good, strong market.”

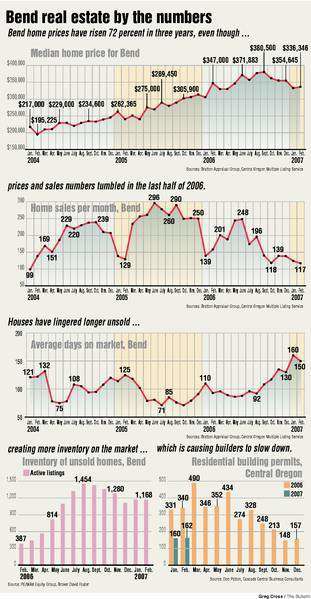

Altogether, the sales numbers look fairly normal for the beginning of a sales year in Central Oregon, with one exception: The inventory. Houses piled up on the Central Oregon market in the last six months of 2006 as investors fled for the exits and buyers sat on the sidelines, waiting for sky-high prices to moderate.

Homes for sale in Bend alone quickly swelled from 387 last February to a peak of 1,454 in August – a 375 percent increase – while sales numbers slumped.

Meanwhile, Bend sales in October, traditionally one of the strongest months of the fall, slipped to 118 last October, less than half of 2004 and 2005 levels.

By August, most of the region’s largest home builders had hit the brakes on their pace of new starts, concentrating instead on shedding their own inventory, according to an analysis by Don Patton, owner of Cascade Central Business Consultants, a Redmond-based company that publishes a monthly analysis of local building trends.

According to Patton’s numbers, Palmer Homes took out 78 percent fewer building permits in the second half of the year than it did in the first. Pahlisch Homes took out 64 percent fewer; Renaissance Homes 85 percent fewer and WoodHill 10 percent fewer.

Given that recent history, the fact that February sales have risen to near normal levels is enough to give some contractors hope for the coming season. Particularly since inventories have dropped – at least, for now.

It’s just not the kind of unrestrained hope that marked the beginning of 2006.

At Renaissance Homes’ Renaissance Ridge development in south Bend, a combination of price cuts and incentives began to bear fruit in February, Renaissance President Randy Sebastian said.

Renaissance put 10 homes in Renaissance Ridge under contract in February, Sebastian said, making Bend the top-selling town in a $30 million month that constituted the best in the Portland-based company’s 22-year history.

February’s success didn’t come without a price.

Renaissance shaved $20,000 to $100,000 off the price of its homes in August, Sebastian said, getting them down to the $350,000 to $700,000 range just to watch them sit through months when ”it didn’t matter whether the homes were virtually free – nobody would buy a home in Bend because there was so much negative press on the prices.”

February’s sales came after Renaissance added $26,000 Mercedes Smart Cars to its incentive mix. Still, Sebastian said he’s taking heart from the types of buyers Renaissance Ridge is attracting, including Bend move-up buyers and buyers from Calilfornia and Portland.

Altogether, Sebastian said, Renaissance plans to build around 70 houses and 15 townhomes in three different subdivisions in Bend, up from the 57 it built last year.

About 1,170 homes were for sale in Bend by the end of February, down slightly from January, according to an MLS analysis on R/E MAX Equity Group Broker David Foster’s Web site.

WoodHill Homes, one of the region’s most prolific builders of 2006, has sold almost all of its leftover inventory, President George Hale said. But he plans to start slow this year, putting up a few demonstration homes to give buyers a feel for the company’s new neighborhoods, then waiting to see how sales go before he starts many more.

”We will still have houses available,” Hale said. ”We’re just not marching down the road blind. If everybody takes that approach, we’ll get back into balance here pretty soon. I hope so, anyway.”

WoodHill is scheduled to build about 110 homes in Bend this year, but Hale said he wouldn’t be surprised if that number slips to around 60 if current trends continue.

Jerry Veenker, president of Hollman Homes, said he’s also hitting the brakes in 2007, partly for personal reasons – he’s 64 and he doesn’t want to work as hard this year – and partly to see where the market goes.

His bet is that inventory levels will plunge again this summer and early fall, whittled away by caution in the construction sector and falling interest rates, creating a profit opportunity in the late fall and spring for the owners of developable lots.

After that, he figures the market will adjust itself again to the region’s natural population growth.

”It’s moving away from a real estate gold rush town to just a stable production/absorption area now,” Veenker said. ”Which is good for all of us. It makes it more predictable.”