Students fill in the blanks – checks, that is

Published 5:00 am Wednesday, October 31, 2007

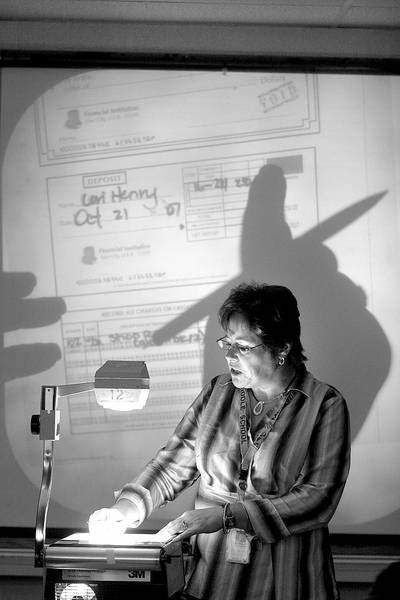

- Food and consumer studies teacher Lori Henry shows students how to fill out a deposit slip for a checking account Tuesday morning at La Pine Middle School.

LA PINE — At 13, La Pine Middle School student Dakotah Karrer doesn’t really need a life insurance policy.

But Dakotah filled out a check to a fictitious insurer Tuesday morning for a lesson in finances.

“There’s so much writing for just a little piece of paper,” he said, explaining that his parents write all the checks at home.

Dakotah was one of roughly 20 students who practiced writing checks and balancing a checkbook Tuesday during a food and consumer studies class at La Pine Middle School. The class, which includes sections about cooking and nutrition, resume preparation and other topics, is intended to equip students with the basic skills they will need in the adult world.

“I teach a lot for after-school, real-life stuff,” teacher Lori Henry said. “A lot of our kids are going on to college, but some of them aren’t.”

Regardless of where students go after graduation, the availability of easy credit makes basic financial knowledge a must, she said.

And while the course does have a unit that involves cooking, it is more wide-ranging, changing from year to year.

Last year, Henry said, the course included time-management and child care skills, geared toward baby-sitting, in addition to food preparation.

Kellie Grigsby, 12, said the variety of topics is one of her favorite things about the course.

“There’s more than one thing that you’re focused on (in class),” she said. “You can learn all different things.”

A seventh-grader, Kellie said she took the class last year and decided to sign up for it again because she enjoyed it.

She said this year’s course has taught her a lot about personal finance.

“It’s a good thing because, when I get older and I am writing checks, I’m already going to know how to do it,” Kellie said.

Dakotah said he has learned skills he will eventually use as an adult and a parent, when he has to cook or write checks for his own children.

He said he never knew about the importance of balancing a checkbook and about getting a paid electronically versus receiving a paper check.

“I think it’s pretty cool — we get to learn (skills) early so we know how to do it when we’re older and not have to rely on other people,” he said.

Darrin Dulley, 12, said his parents taught him how to write checks, but he never knew how to deposit one before.

“I (also) didn’t know about bouncing checks before, or (how) it costs $25 to $35,” he said.

Nieca Kentner, 12, said she signed up for the class because she wanted to cook, but appreciated learning about finances.

The students researched typical salaries for different careers, she said, and will learn about budgeting for expenses such as rent and utility bills.

A seventh-grader, Nieca said she was surprised to find out how much it actually costs to make a living.

“This (class) will definitely be useful,” she said.