Double-majority law goes back to voters

Published 5:00 am Thursday, September 18, 2008

- Double-majority law goes back to voters

SALEM — Supporters hailed the passage of Oregon’s double-majority law in 1996 as a contemporary equivalent of the Boston Tea Party: It showed, they said, that voters were fed up with at a system that allowed a small minority of people to foist new taxes on the population at large.

The standard, part of a package written by Klamath Falls anti-tax activist Bill Sizemore, said that — except in even-year general elections, which occur in November every two years — any property tax-raising ballot measure cannot be enacted unless at least half of eligible voters cast ballots.

Trending

That created the so-called double-majority rule: A majority of voters have to cast ballots, and then a majority of those have to approve the tax measure.

Proponents say it is only fair that a minimum number of voters participate in elections that could cost you money.

Yet to critics, the double majority is democracy gone awry, because it rewards people who don’t vote at all — by giving them extra sway.

Oregon voters — who narrowly rejected a proposed repeal of the double-majority law in 1998 — will revisit the law again, in Measure 56 on the Nov. 4 ballot.

If voters approve the measure, the double-majority threshold would no longer apply in May and November elections, but would still be in effect the rest of the year. That would give those seeking additional taxes two elections each year to get their measures approved without needing a 50 percent voter turnout.

Lawmakers referred Measure 56 to the ballot at the behest of officials from schools and other local government bodies who have seen their tax requests scuttled, because of the double-majority requirement.

Trending

Critics of the double-majority rule say it allows opponents of a tax measure to help torpedo it — even if it is passing by a wide margin — by tossing their ballots in the trash and helping to keep turnout shy of 50 percent.

“People need to exercise their right to vote,” state Rep. Chuck Burley, R-Bend. “Those that do vote, and their votes don’t count because others chose not to, I don’t think that’s right.”

Bend attorney Judy Stiegler, a Democrat who is running against Burley, agreed.

“A true measure of public support is when you get a yes or no — not when you allow an escape clause in the process, and that’s what it has done,” she said. “It’s undemocratic when you are discouraging people to show up and vote.”

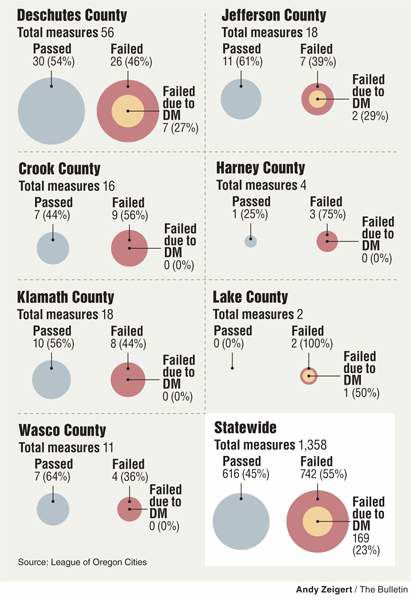

Between 1997 and 2007, the double-majority standard stymied 169 local tax increases because too few people voted, according to statistics compiled by the League of Oregon Cities. And of those, 71 would have passed even if all the votes needed for a 50 percent turnout had been “no” votes.

That’s out of a total of 1,358 measures during that span, or about 12 percent.

Among the failed measures were sheriff’s levies in Deschutes County and a local option levy for the La Pine Rural Fire Protection District. A series of those measures won in terms of yes-to-no votes, yet they failed because of insufficient turnout.

The La Pine district is asking voters again in November to approve a levy of 64 cents per $1,000 of assessed property value to replace an expired levy — and would have been renewed if not for the double-majority law, said Fire Chief Jim Gustafson.

Voters approved the levy by a 75 percent to 25 percent margin this year, yet the election was disqualified because only 48 percent of voters in the district cast ballots.

The double-majority standard has not served public safety in La Pine, he said. What’s more, it has required the district to keep paying for elections.

Proponents of the law argue it has been a modest tool to help to keep government spending in check, and they compare the law to the requirement that city councils, county commissions, and other governing boards and government bodies have a necessary quorum, or majority, of members before doing any business.

Steve Buckstein, the director of the Cascade Policy Institute, a Portland-based conservative-leaning think tank, said that he’d prefer an even tougher hurdle.

Assume 50 percent of eligible voters cast ballots, and just over half of those approve, he said. That translates into just more than 25 percent of voters that can raise taxes, he said.

“To me, that bar is too low,” he said.

There are other ways the public has limited democracy, he said. For instance, voters have already decided that legislators cannot raise taxes unless 60 percent of them approve, Buckstein said.

“There will be four times more ballots for government to try and pass tax measures with no minimum of voters, instead of one election every two years. That’s functionally a repeal.”

And state Sen. Doug Whitsett, R-Klamath Falls, whose district includes Crook County, said government officials at all levels — from the state to schools — have a spending problem, and the double majority has prevented them from “slipping tax measures” into off-year elections in which few people participate.

“I think it is serving its purpose well, and I’m not about to vote to take it out.”

But Burley said one of the reasons cited by double-majority supporters no longer applies.

Oregonians now get their ballots in the mail, so it is not possible to sneak a tax proposal past unsuspecting voters, he said.

“I don’t see how it could be any easier to participate in democracy as we have it in Oregon,” he said. “You’ve got time. Mark it, seal it, slap a stamp on it and send it out.”

Measure 56

“Amends Constitution: Provides that May and November property tax elections are decided by majority of voters voting.”

Chief petitioner: Referral from 2007 Legislature

Fiscal impact: None

Pro: Oregon’s double-majority threshold discourages voting and has frustrated the efforts of local governments and schools to raise money. Defend Oregon Coalition. www.defendoregon.org.

Con: The law should not be weakened because it has protected the population at large from taxes enacted by a minority of voters. Government officials should put tax requests on ballots with high turnouts. Bill Sizemore, 541-892-8050.