A top trader is charged in massive fraud

Published 4:00 am Friday, December 12, 2008

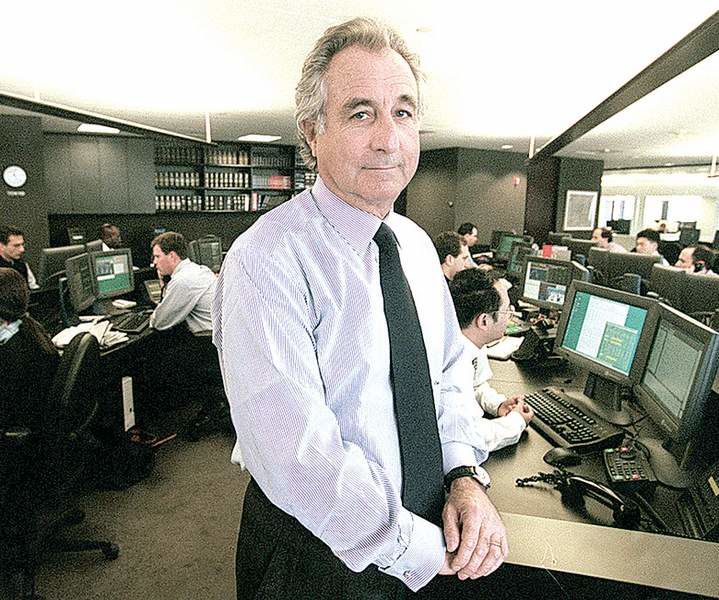

- Bernard Madoff, founder of Bernard L. Madoff Investment Securities, was arrested Thursday by federal agents and charged with criminal securities fraud stemming from his company’s money management business.

NEW YORK — On Wall Street, his name is legendary. With money he had made as a lifeguard on the urban beaches of Long Island, he built a trading powerhouse that had prospered for more than four decades. At age 70, he had become an influential spokesman for the traders who are the hidden gears of the marketplace.

But on Thursday morning, this consummate trader, Bernard Madoff, was arrested at his Manhattan home by federal agents who accused him of running a multibillion-dollar fraud scheme — perhaps the largest in Wall Street’s history.

Regulators have not yet been able to verify the scale of the fraud. But the criminal complaint filed against him in federal court in Manhattan on Thursday reports that Madoff himself estimated the losses at $50 billion.

“We are alleging a massive fraud — both in terms of scope and duration,” said Linda Chatman Thomsen, director of the enforcement division at the Securities and Exchange Commission. “We are moving quickly and decisively to stop the fraud and protect remaining assets for investors.”

Andrew Calamari, an associate director for enforcement in the SEC’s regional office in New York, said the case involved “a stunning fraud that appears to be of epic proportions.”

According to his lawyers, Madoff was released on a $10 million bond. “Bernie Madoff is a long-standing leader in the financial services industry,” said Daniel Horwitz, one of his lawyers. “He will fight to get through this unfortunate set of events.”

Madoff’s brother and business colleague, Peter Madoff, also declined to comment on the case or discuss its implications for the firm, which at one point was the largest market maker on the electronic Nasdaq market, regularly operating as both a buyer and seller in the marketplace. The firm employed hundreds of traders.

There was some worry on Wall Street on Thursday that Madoff’s fall would shake more foundations than his own.

According to the most recent federal filings, Bernard L. Madoff Investment Securities, the firm he founded in 1960, operated more than two dozen funds overseeing $17 billion. These funds have been widely marketed to wealthy individuals, hedge funds and other institutional investors for more than a decade. An SEC filing in the case said the firm reported having 11 to 23 clients at the beginning of this year.

At the request of the SEC, a federal judge appointed a receiver on Thursday evening to secure the Madoff firm’s overseas accounts and warned the firm not to move any assets until he had ruled on whether to freeze the assets. A hearing on that request is scheduled for today.

‘Too good to be true’

The Madoff funds attracted investors with the promise of high returns with low fees. One of his more prominent funds, the Fairfield Sentry fund, reported having $7.3 billion in assets in October and claimed to have paid more than 11 percent interest per year through its 15-year track record.

Competing hedge fund managers have wondered privately for years how Madoff generated such high returns, in bull markets and bear, given the generally low-yielding investment strategies he described to his clients.

“The numbers were too good to be true, for too long,” said Girish Reddy, a managing director at Prisma Partners, an investment firm that invests in hedge funds. “And the supporting infrastructure was weak.” Reddy said his firm had looked at the Madoff funds and decided against investing in them because their performance was too consistently positive, even in times when the market was incredibly volatile.

But the essential drama is a personal one — one laid out in the dry language of a criminal complaint by Lev Dassin, the acting U.S. attorney in Manhattan, and a regulatory lawsuit filed by the SEC.

According to those documents, the first alarm bells rang at the firm Tuesday, when Madoff told a senior executive he wanted to pay his employees their annual bonuses in December, two months early.

Just days earlier, he had told another senior executive he was struggling to raise cash to cover about $7 billion in requested withdrawals from his clients, and he had appeared “to have been under great stress in the prior weeks,” according to the SEC complaint.

So on Wednesday, the senior executive visited Madoff’s office, maintained on a separate floor with records kept under lock and key, and asked for an explanation.

Instead, Madoff invited the two executives to his Manhattan apartment that evening. When they joined him there, he told them that his money-management business was “all just one big lie” and “basically, a giant Ponzi scheme.”

The senior employees understood him to be saying that he had for years been paying returns to certain investors out of the cash received from other investors.

In that conversation, according to the criminal complaint, Madoff “stated that he was ‘finished,’ that he had ‘absolutely nothing.’”

By this account, Madoff told the executives he intended to surrender to the authorities in about a week but first wanted to distribute approximately $200 million to $300 million to “certain selected employees, family and friends.”

On Thursday morning, however, he was arrested on a single count of securities fraud, which carries a maximum penalty of 20 years in prison and a maximum fine of $5 million.

According to the SEC, Madoff confessed to an FBI agent that there was “no innocent explanation” for his behavior and said he expected to go to jail. He had lost money on his trades, he told the agent, and had “paid investors with money that wasn’t there.”