The mysterious future of $733M

Published 5:00 am Monday, October 5, 2009

- The mysterious future of $733M

Oregonians are almost certain to be voting in January on two taxes approved by the Legislature. And there are going to be a lot of arguments put forward between now and then about why the $733 million in new taxes should be approved or rejected.

Will the state be better off with the taxes or without them?

It would be nice if the answer was simple. It’s not.

Turn to economists for exact answers, and there are likely to be inexact answers and best judgments instead. That’s what Oregon legislators got last week from a report by the Legislative Revenue Office.

Paul Warner, legislative revenue officer, told us the state’s economy will likely be “less worse off” if voters approve the taxes rather than force the state to make cuts to balance its budget.

There are a lot of reasons behind that, he explained. State government will likely spend the money. It may be able to attract federal matching funds with some of it. Increases in state taxes are softened a little by federal tax deductions.

On the other hand, consumers would likely save some of the money or use it to pay down debt rather than spend it all.

Many economists would agree with that short-term assessment. It’s the effects in the longer term that get much more controversial.

Warner said that a lot depends on what state government does with the tax revenue. How wisely is it spent and how soon?

Harvard economist Robert Barro told us he does not believe there is empirical evidence to support a conclusion that it is better to stimulate the economy with government spending rather than reducing taxes. He argues the opposite may be true.

Legislators did not, though, propose the two permanent tax increases primarily as economic stimulus. They were trying to avoid cuts in the state budget.

One of the new taxes establishes new tax rates for higher-income Oregonians. The second raises corporate minimum taxes and increases corporate tax rates on businesses with net incomes of more than $250,000. It’s estimated that the two measures will raise some $733 million for the 2009-11 biennium. If voters reject the taxes, the state must cut programs, employees, or wages and benefits.

What voters must weigh is if they think the plans the state has for the $733 million and millions more in the future are better than keeping the $733 million in the hands of taxpayers. It would help to know what the state will do with the $733 million.

It’s too bad that is not spelled out. This is not like a school bond which must itemize exactly how the money will be spent.

We’re just buying government, in general.

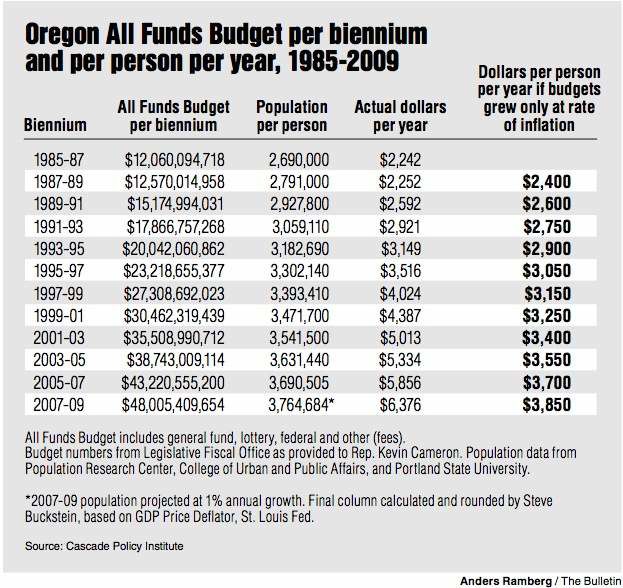

Oregon government has been getting bigger. It does more. It’s mission creeps. Take a look at the chart below. More and more money is being spent each year per Oregonian on government, even if inflation is accounted for.

To make a decision if Oregon will be better off with the new taxes, Oregonians need to be able to better weigh the pros and cons of what they will get.