Bank of the Cascades seeks to raise $150M

Published 5:00 am Friday, October 30, 2009

- Bank of the Cascades seeks to raise $150M

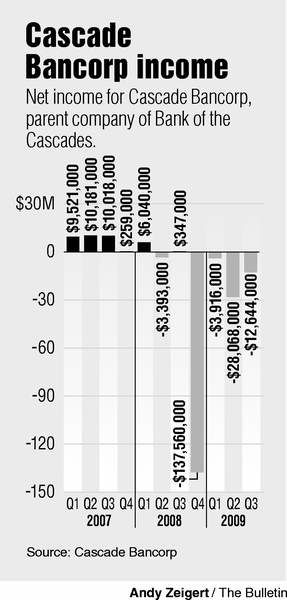

Cascade Bancorp, shortly after reporting a $12.6 million loss in its third quarter that ended Sept. 30, announced Thursday it has entered into agreements with its largest investor and a New York City-based hedge fund to raise $150 million in a public and private stock offering to recapitalize the Bank of the Cascades.

The offerings are expected to put the bank, which is a wholly owned subsidiary of the company, in compliance with a cease and desist order issued against it in late August by the Federal Deposit Insurance Corp. that required the bank to, among other things, raise its capital levels.

Specifically, the order requires the bank to raise its Tier 1 leverage ratio — one of three important capital ratios regulators measure to assess a financial institution’s health — to at least 10 percent by February 2010, even though regulators consider a bank “well-capitalized” if the ratio is 5 percent or greater.

In its quarterly earnings statement released Thursday, the company reported the bank had a Tier 1 leverage ratio of 5.76 percent as of Sept. 30.

Cascade Bancorp has ended four consecutive quarters in the red and lost more than $182 million during that time as it works to untangle itself from poor-performing real estate development loans in Oregon and Idaho.

The company announced that David Bolger, its largest investor with a 21.44 percent stake, and Lightyear Capital LLC will purchase $25 million and $40 million, respectively, of the company’s common stock in private offerings if the company raises at least $85 million — after commissions and fees — through a public stock offering.

Patricia Moss, the company’s president and CEO, said with $150 million, “we would significantly exceed (the) well-capitalized (threshold).”

Moss added that both Bolger and Lightyear Capital “completed a significant amount of due diligence prior to entering into these (stock) purchase agreements.”

Neither Bolger nor Lightyear could be reached for comment late Thursday. Analysts also could not be reached.

Seeking approval from shareholders

The company has called a special shareholders meeting in December to amend the company’s articles of incorporation to authorize it to increase the amount of shares it can issue from 45 million to 300 million, Moss said.

A meeting date has yet to be set.

Once the offerings were complete, Moss said the board would seek shareholder approval to authorize a 1-for-10 reverse stock split, meaning shareholders would receive one share for every 10 they own.

In the registration statement for the public offering the company filed earlier this month, the company said the issuance of additional shares of common stock could be dilutive to shareholders, but Moss said the exact effect depends on the stock’s offering price.

Similar stories at other Oregon banks

Three Oregon banks — West Coast, Umpqua and Pacific Continental — have all completed stock offerings in the past year that raised new capital, in the amount of $155 million, $200 million and $45 million, respectively.

Like them, Cascade Bancorp has been buffeted by declining real estate values that have driven down the value of loan collateral and bank-owned real estate properties.

In the third quarter, the company reported a loss of 45 cents per share due to a $22 million loan loss provision and increased expenses, Moss said.

The company reported a loss of $28.1 million, or $1 per share, in its second quarter that ended June 30, and a profit of $347,000, or 1 cent per share, in the year-ago quarter that ended Sept. 30, 2008.

Moss said the real estate market continues to show signs of stabilization, noting that the company’s third-quarter loan loss provision of $22 million was less than the $48 million loan loss provision the company posted in the second quarter, a decline of more than 54 percent.

A loan loss provision is money a bank sets aside to cover loans expected to default and is accounted for as an expense.

“The (third-quarter loss) is significantly less than the loss last quarter, and it’s again mainly due to the provision for loan losses,” Moss said. “The good news is we had reported that nonperforming assets were appearing to stabilize, and they were slightly down this quarter.”

The third quarter

The company reported its nonperforming assets — or loans which borrowers have stopped paying — decreased in the third quarter to $197.3 million, or 8.7 percent of total assets, compared with $204.1 million, or 8.5 percent of total assets in the second quarter. The company also reported that its land development portfolio “is nearly all classified as (nonperforming).”

Moss said the company was hindered by higher expenses in the third quarter, including FDIC insurance premiums that have risen more than 266 percent from the same quarter a year ago, and a 2,175 percent increase in the amount of real estate expenses. The company spent $432,000 on real estate it owned in the third quarter of 2008 compared with $9.8 million in the third quarter of 2009.

Moss said the increase in real estate expenses is the result of the drop in real estate value, causing the bank to record higher expenses when properties it sells or has appraised lose value.

Cascade Bancorp shares fell 6 cents, or 5.61 percent, to close Thursday at $1.01 in Nasdaq trading.