Goodbye Medicare “doughnut hole”

Published 4:00 am Thursday, December 8, 2011

- Goodbye Medicare “doughnut hole”

It’s time to say goodbye to the doughnut hole.

A combination of discounts, subsidies, education and generic alternatives are helping eliminate a coverage gap in the Medicare Part D drug benefit — dubbed the “doughnut hole” — that often left beneficiaries angry and confused.

So by the end of the decade, the only doughnut holes beneficiaries will have to face will be at the pastry shop.

When lawmakers created the drug benefit in 2006, they opted to give everyone at least some assistance with costs, and then used the remainder of the limited funds available to help those with the lowest incomes or the highest drug costs. The result was a huge gap in coverage that came to be known as the doughnut hole.

Seniors could go into the pharmacy one day with drug coverage, then find they had no coverage the next day because their spending had pushed them into the doughnut hole.

“People were not used to it,” said Elma Friend, owner of Willamette Valley Benefits in Portland. “They hit the doughnut hole in three months and were done.”

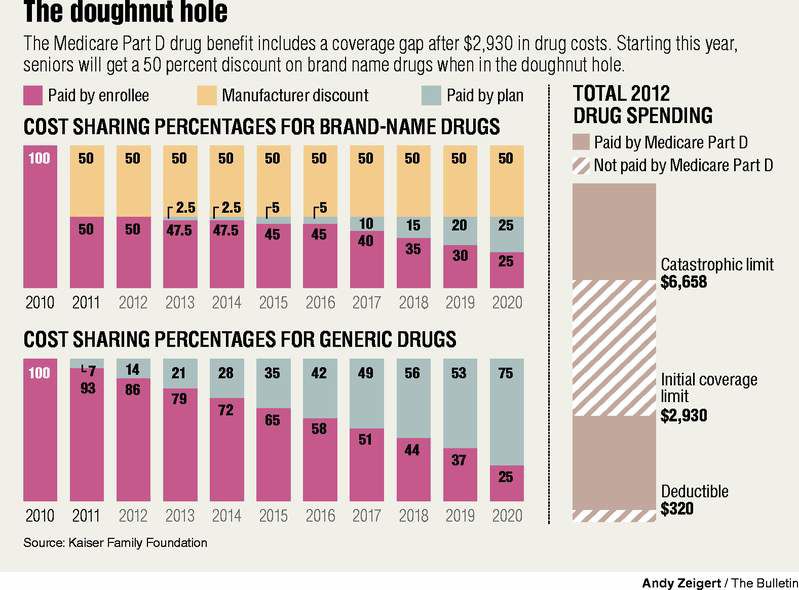

Last year, however, the health reform law began the process of filling the doughnut hole. Beneficiaries who reached the coverage gap in 2010 received a $250 rebate and this year received a 50 percent discount on the cost of their drugs. The discounts, along with a 7 percent subsidy for the cost of generic drugs, cut average costs for beneficiaries in the doughnut hole this year from $1,504 to $907.

“It helps people who have been hit hard by having to pay the full cost of their drugs when they reach the gap,” said Juliette Cubanski, associate director of Medicare policy for the Kasier Family Foundation. “The coverage gap has been a big thorn in the side of Part D enrollees since the drug benefit was created.”

Under the standard plan design, beneficiaries had to meet an initial deductible then paid 25 percent of drug costs until they reached the coverage gap. Until this year, they had no further coverage until they reached a cap on out-of-pocket spending.

Significant savings

Without the discounts, most seniors would have been covered until they spent $2,930 in prescriptions in 2012, but would have no help in paying for the next $3,728 worth of drugs.

Cubanski said fewer than one in five seniors reached the coverage gap in 2009, and only 3 percent hit the out-of-pocket spending cap, after which they faced only a minimal copay.

More than 33,000 Medicare beneficiaries in Oregon have benefited from the discounts this year, saving an average of $496 each through the first 10 months of the year, or a total savings of $16.4 million. Nationwide, 2.7 million beneficiaries entered the coverage gap this year and saved a combined $1.5 billion.

“It’s going to be really helpful for people to get the 50 percent discount and that discount is going to keep getting larger,” Cubanski said. “By 2020, it will be a seamless benefit design from the end of the deductible period to the beginning of the catastrophic cap.”

That’s because in 2013, Medicare will begin subsidizing the cost of brand name drug coverage in the doughnut hole a little more each year. By 2020, beneficiaries will receive both the 50 percent discount from the drugmaker and a 25 percent subsidy from Medicare, leaving them responsible for only 25 percent of the drug’s cost under the standard plan design.

The health reform law also established subsidies for generic drugs in the coverage gap. While generic drugs are cheaper, they are not discounted 50 percent as brand name drugs are.

Instead, the health reform law established a 7 percent subsidy for generic drugs in the doughnut hole in 2011, increasing by 7 percent each year. By 2020, beneficiaries will pay only 25 percent of the costs of generics in the coverage gap as well, essentially eliminating the doughnut hole.

Changing tiers

Prescription drug plans have some flexibility in plan design and most use different copayments to encourage patients to choose less costly alternatives. Generics are generally the least costly for the drug plan and so copayments on generics are often significantly lower.

According to an analysis by Avalere Health, preferred generic drugs will cost beneficiaries an average of $3.79 per prescription in 2012. Average copays for nonpreferred generics will drop from $17.29 in 2011 to $9.90 next year.

Average copayments for preferred brand name drugs — generally those drugs for which the plans could negotiate a discount — will increase from $29.01 per prescription to $40.60.

“It’s once you get on the nonpreferred or specialty tier drugs, that’s where we’re starting to see some of the cost sharing increases,” said Corey Ford, a manager at Avalere. “By doing that, they are trying to get beneficiaries to look at their treatment options.”

Average copays for nonpreferred brand name drugs will increase from $71.52 in 2011 to $91.67 in 2012. Copayments for the most expensive drugs in the specialty tier will rise from 27 percent of the drug cost to 32 percent.

Individual beneficiaries may find their copays differ significantly from the averages based on the types of drugs they take and their individual plan designs. But Ford said, in general, drug plans are trying to make beneficiaries better consumers. Seniors are getting more knowledgeable about the differences in costs between brand names and generics, and between preferred and nonpreferred drugs under their plans, and asking their doctors about cheaper alternatives.

“They’re becoming more active in the decision-making process in that physician-patient relationship,” Ford said.

That’s due in part to seniors groups such as AARP or assistance organizations, such as the Central Oregon Council on Aging, which help to educate seniors on how to choose the best plan for them, and how to make the best use of the benefit. The more seniors understand how the program and the doughnut hole works, the less likely they are to get caught in it.

“If they’re not educated correctly or they don’t understand to watch their monthly statements from their insurance company, they’re going to hit the doughnut hole and then they have this shock,” said Friend, the Portland-based insurance broker. “That’s the goal for us — to not have that shock factor.”

Willamette Valley Benefits has been conducting regular outreach with seniors to help them learn about their options. They teach seniors how to talk to the doctors about lower cost alternatives and map out the exact month when they can expect to reach the coverage gap based on their current medications so they’re not surprised.

“I see more and more clients trying generics and using the $4 programs in the pharmacies — the Walmarts, the Targets, the Freddies — outside of the benefit so they can utilize their Part D benefit for the expensive medicine that they can’t go generic on,” she said.

And with a number of blockbuster brand name drugs expected to go generic in the next 12 months, it could keep even more seniors out of the hole.