New owners for local nursing homes

Published 5:00 am Thursday, October 4, 2012

- New owners for local nursing homes

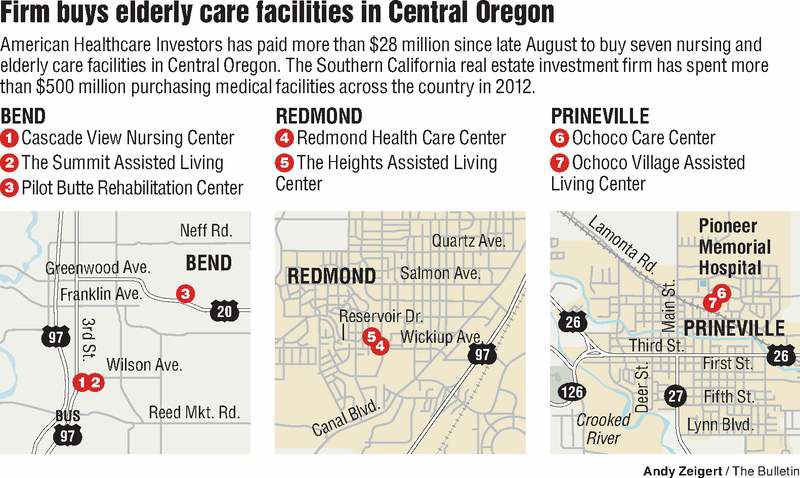

A Southern California real estate investment firm is the new owner of seven Central Oregon nursing homes and elderly care centers.

American Health Care Investors paid $28.9 million in total between Aug. 20 and Aug. 30 to buy the seven facilities in Deschutes and Crook counties from Bellevue, Wash.-based Regency Pacific.

Trending

But officials with American Health Care Investors and Regency Pacific said patients at the centers shouldn’t expect any immediate changes in service. Regency, a West Coast provider of senior care services, will remain as administrators of the sites, with American Health Care Investors owningthe buildings, said Geralyn Kidera, general counsel for Regency.

American Health Care Investors, headquartered in Newport Beach, bought three Bend care facilities — Cascade View Nursing Center, The Summit Assisted Living and Pilot Butte Rehabilitation Center — all on Aug. 20, according to Deschutes County Clerk’s Office property records.

It bought two Redmond facilities on Aug. 24: Redmond Health Care Center and The Heights Assisted Living Center.

And they entered the Crook County market on Aug. 30, buying Ochoco Care Center and Ochoco Village Assisted Living in Prineville.

An Oregon limited liability company affiliated with Regency’s Bellevue office had owned all of the care centers, according to property records in Deschutes and Crook counties.

But the facility purchases by the California company are “merely a change in landlords,” Kidera said. “I don’t see any changes coming from that.”

Trending

American Health Care Investors has had a busy year. Along with a partner firm, Griffin Capital Corp., based in El Segundo, Calif., American Health Care Investors bought dozens of medical facilities across the country this year.

Griffin Capital has $1.7 billion in real estate assets nationwide, according to its website.

And American Health Care Investors has grown its portfolio considerably since January, said Damon Elder, senior vice president of marketing for the company.

It had $438 million in total assets on Jan. 1, Elder said. By Oct. 1, the portfolio had grown to $1.1 billion, highlighted by major purchases in Texas, Tennessee, Georgia, California and Arizona.

The August purchases mark the Newport Beach company’s first venture into Oregon. The firm owns medical office buildings, hospitals and nursing facilities in 18 other states, according to its website.

Elder said he couldn’t comment on the firm’s real estate investment strategy, or on any long-term plans for the Central Oregon facilities it bought.

But he did point to government figures predicting a rise in demand for health care services — and facilities — over the next decade as an incentive for investors to buy medical office buildings.

A June report from the Centers for Medicare and Medicaid Services showed that 17.9 percent of U.S. gross domestic product is spent on health care. The report also estimated the figure would reach nearly 20 percent by 2021, citing the continued aging of baby boomers and the expansion in health care services starting in 2014.

“It’s all about the demographic changes in the country,” Elder said, “the aging of the American population and the constantly growing demand for health care services. Health care is the place to be. It’s already the single largest part of GDP.”

Kidera with Regency said she couldn’t rule out the possibility of any long-term changes in service at the centers now owned by American Health Care Investors. But any changes would be routine moves to improve service for patients, she said.

“We’re constantly looking at the services we provide, and how we can broaden them as the needs of our population become more acute,” she said. “That doesn’t really have to do with” the purchases.