Guidance through the Medicare maze

Published 4:00 am Friday, November 30, 2012

- Guidance through the Medicare maze

Central Oregon Medicare recipients have one week left before Medicare’s open enrollment period expires Dec. 7.

If they don’t make any health coverage changes before open enrollment ends, they will be stuck with their existing plan, even if it doesn’t meet their health care needs.

“We hope people will call us if they have questions,” said Steven Guzauskis, a local coordinator with Oregon’s Senior Health Insurance Benefits Assistance Program. People can learn more about their Medicare options by calling SHIBA at 800-722-4134.

Medicare’s open enrollment period is when most Medicare beneficiaries can sign up to receive or change their existing benefits from a Medicare Advantage plan or a Medicare Part C plan.

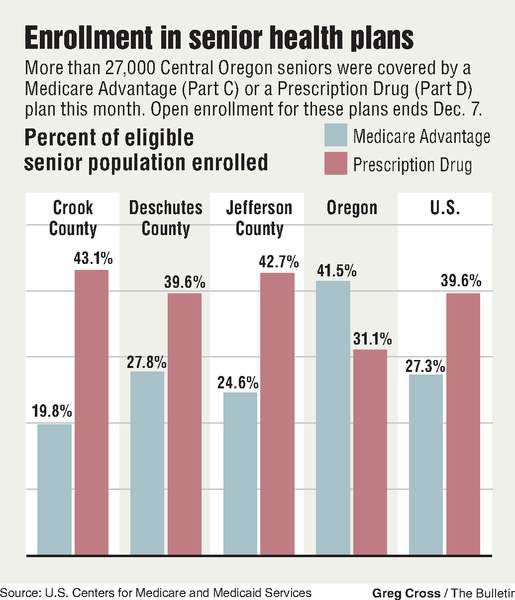

These privately managed plans — which covered 10,718 Central Oregon residents this month, according to the U.S. Centers for Medicare and Medicaid Services, are an alternative to the government-managed Medicare Part A and Part B plans that cover in-patient hospital stays, nursing home stays, doctor visits, medical supplies, hospice care and other health care services.

Open enrollment is also when most beneficiaries can sign up for a Medicare prescription drug plan or change their existing prescription drug coverage options.

These plans, known as Medicare Part D, cover another 16,394 Central Oregon residents, according to CMS.

The only times people can change their Medicare options outside of the open enrollment period is if they move where their coverage options may change, when they first become eligible for benefits and when they’re current Medicare plans decide to stop offering benefits.

“If they just forgot to do it, that’s not a good reason,” said Lisa Emerson, the state’s SHIBA program manager.

Guzauskis said it’s important for Medicare beneficiaries to understand their health care needs, especially when it comes to what drugs they take, and how those needs can change over the coming year.

He said it’s also important to know what options are out there, even if they are happy with their current health insurance arrangement, because Medicare plans change their prices, benefits and coverage areas each year.

According to SHIBA’s website, residents of Crook, Deschutes, and Jefferson counties can receive benefits from seven Medicare Advantage plans — five of which include prescription drug coverage — offered by ODS Health Plan and PacificSource Medicare. Plans range in price from $19 to $139 a month.

They can get also benefits from one of 30 Medicare prescription drug plans that range from $15 to $122 a month.

The goverment-sponsored Medicare Part B coverage will cost $105 a month for most people in 2013, while Medicare Part A coverage is free for any person who has worked and contributed to the Medicare system for at least 10 years.

Medicare plans

The federal program provides health insurance coverage to seniors, people with certain disabilities and people who suffer from end-stage renal disease. It comes in four parts:

• Hospital insurance coverage (Medicare Part A): A government-managed health insurance plan that is free to anybody who has worked for 10 years; pays for outpatient hospital stays, skilled nursing home stays, home health services and hospice care.

• Medical insurance coverage (Medicare Part B): A government-managed health insurance plan that costs $105 a month; pays for doctor visits, medical supplies, outpatient services and other medically necessary treatments.

• Medicare Advantage (Medicare Part C): A government-subsidized program where privately managed health insurance companies like ODS Health Plan and PacificSource Medicare provide the same level of coverage found in Medicare Part A and Part B.

• Medicare Prescription Drug Coverage (Medicare Part D): A program where privately managed companies provide prescription drug coverage to people who receive Part A and Part B or a Medicare Advantage plan.

To learn more about or to select your Medicare options, visit www.medi care.gov or call the Senior Health Insurance Benefits Assistance program’s toll free line at 800-722-4134.