Vitamins hop on the ‘clean label’ bandwagon

Published 12:00 am Sunday, May 29, 2016

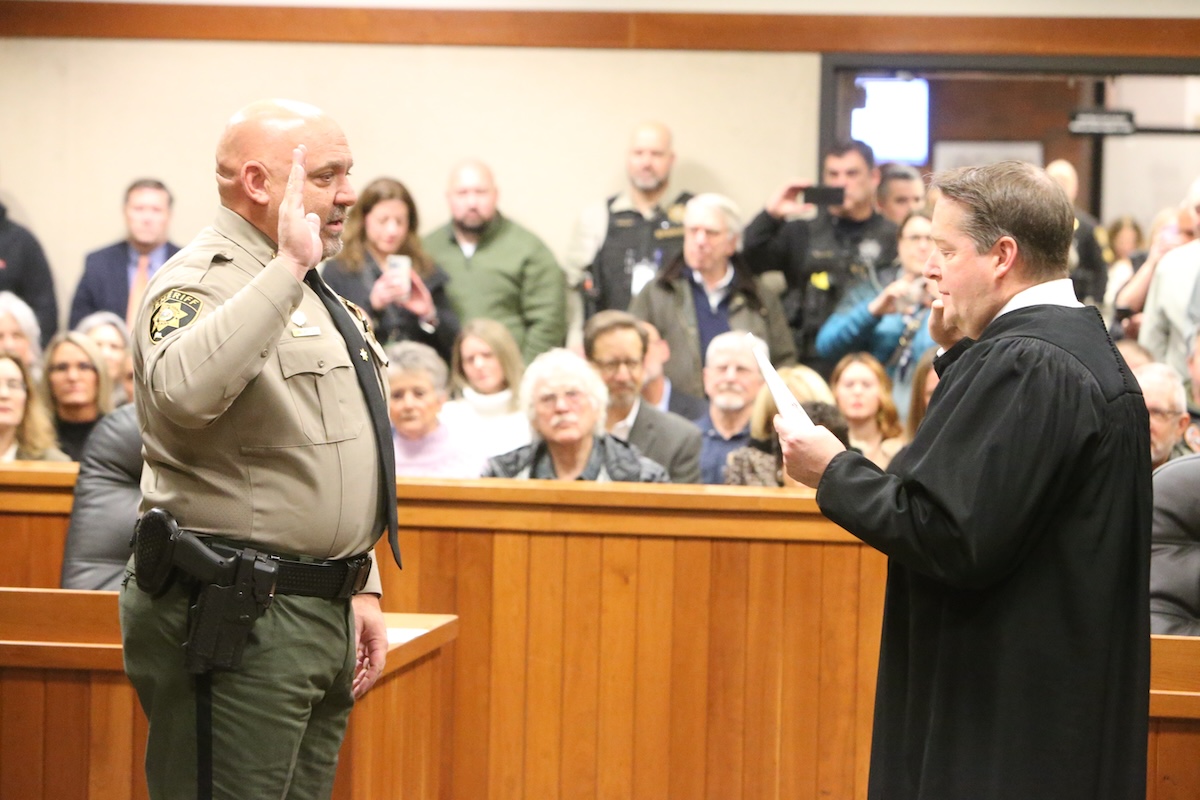

- Monica Almeida / The New York TimesKaterina Schneider is the founder of Ritual, which makes so-called “clean label” vitamins.

When she was about four months pregnant, Katerina Schneider read the ingredient list on the bottle of vitamins her doctor had recommended.

On it were things such as aluminum and titanium dioxide, some of the same ingredients in the laundry detergents and cleaning products she had been throwing away to help ensure her baby was not exposed to them.

She also wondered why the vitamin contained gelatin — and, as a vegan, where the gelatin came from. Gelatin is usually derived from animals.

These discoveries and questions spawned a new business idea: What if she could re-engineer vitamins, stripping out all the things she didn’t like?

“I realized that most people didn’t know if the vitamins they were taking had what they needed, or where the ingredients in those vitamins came from or even what they were,” Schneider said. “Nor did they know if they worked.”

The idea has attracted more than $1 million in financing from angel investors, including Upfront Ventures and Troy Carter. Now, the company she founded, Ritual, is about to find out how much this matters to consumers. On Thursday, the company will begin marketing its first product, a multivitamin, the latest in a surge of products that are part of what the food industry calls the “clean label” or “free of” movement. Ritual will begin shipping the multivitamin in July, based on sales by online subscription.

Consumers wanting to know where ingredients come from and why they are needed in a product have pushed companies like Campbell Soup, General Mills and Nestlé to rid many of their products of substances such as carrageenan, high-fructose corn syrup and artificial colorings.

Now, some of the same efforts are coming to vitamins, an $80 billion annual business in the United States. Last year, Eric Ryan, co-founder of Method cleaning products started Olly, a line of so-called clean vitamins sold online and through Target and other stores. And SmartyPants Vitamins, a line of gummy vitamins that ticks many of the “free of” boxes, has raised a total of $19.5 million from investors since it began sales in 2010.

“There’s been this growing interest in transparency we’ve seen across consumer packaged goods and especially food,” said Chris Schmidt, who tracks consumer health products at Euromonitor, a global data collection and analysis firm. “If anything, the vitamin and dietary supplement industry has been late to the party.”

He said vitamins were now getting the same scrutiny as foods.

“People are starting to realize this is something I get nutrition from, so why am I not being as demanding of a vitamin as I am of that bag of chips?” he said.

Schmidt said vitamin and supplement businesses became aware of a growing challenge as food businesses have tried to untangle their vitamin supply chains to satisfy curious consumers and picky certification agencies.

But when companies tried to get certification that products like vitamin-fortified cereals were free of genetically engineered ingredients, or non-GMO, they hit a brick wall.

“Third parties doing certification like the Non-GMO Project require a whole lot more information than most vitamin companies are used to handing over,” said Bethany Davis, a spokeswoman for the Coalition for Supplement Sustainability and director of industry and regulatory affairs at FoodState, a vitamins and supplements company.

The coalition was formed by vitamin and supplement companies last year after food companies began dropping vitamins from their products. General Mills reduced the amount of riboflavin, or vitamin B2, and magnesium in the original Cheerios. Post Foods ditched vitamin A, vitamin D and vitamin B12 in the original Grape-Nuts.

“These large companies may have difficulty getting enough supply of vitamins to make non-GMO claims because the supply chains are very complex and it’s not the industry standard to have full transparency,” Davis said.

She said most vitamins were non-GMO because they came from a global supply chain that also serves businesses in countries where products with genetically altered ingredients have long required labels.

But some, like vitamin A, vitamin B12, ascorbic acid and beta-carotene, which typically are derived from genetically modified crops like soy and sugar beets, are hard to certify.

“The supply chain is very complex and getting all the documentation can be tricky,” Davis said.

Even Schneider, who set out to make a non-GMO multivitamin, could not make a product completely free of genetically engineered ingredients.

“Any ingredients in our product that are plant-based are non-GMO,” she said. “We do have some synthesized ingredients, made in a lab, that can’t be non-GMO — but we’re still trying to get there.”

Aiming for transparency

The Food and Drug Administration does not review the safety or effectiveness of dietary supplements before they go on the market. But Ritual plans to make public the supply chains for the vitamins it includes in its products, Schneider said. The company’s website will also offer the research supporting the formulation of its products, which differ from many of the multivitamins sold today.

“The vitamin industry is a black box for people right now,” Schneider said.

Ritual multivitamins have just nine vitamins and minerals, compared with more than 20 in many competitors’ supplements. Schneider said most multivitamins were formulated decades ago and don’t take into account the nutrients inherent in many of today’s diets or the restrictions some diets have.

For instance, although Ritual is targeting women, the multivitamin doesn’t include calcium. Rather, Schneider said the product is formulated with vitamin K2, boron and magnesium with a special coating that improves absorption, all of which aim to improve the uptake of calcium in foods.

To accommodate vegan diets, Ritual’s vitamin D3 is derived from lichen rather than lanolin from sheep’s wool, and its Omega-3 comes from algae instead of fish.

The pills themselves resemble tiny, elongated snow globes; the vitamins and minerals they contain are suspended in an oil that promotes better uptake in the body, Schneider said. Ritual has adopted a subscription model for distribution, 30 days’ worth for $30. The company begins shipping in July.

Schneider said she knew that her formulation might raise eyebrows but was confident of the research behind it. Dr. Luke Bucci, who was responsible for substantiating claims as an executive at Schiff Nutrition International before it was sold for $1.4 billion to Reckitt Benckiser, is Ritual’s head of research and development.

“Nothing is in our product that doesn’t have a clinical trial of some sort behind it,” she said. “But I know people will just have to try it before they believe.”