Napier guides expansion at Karnopp Petersen

Published 11:56 pm Tuesday, June 13, 2017

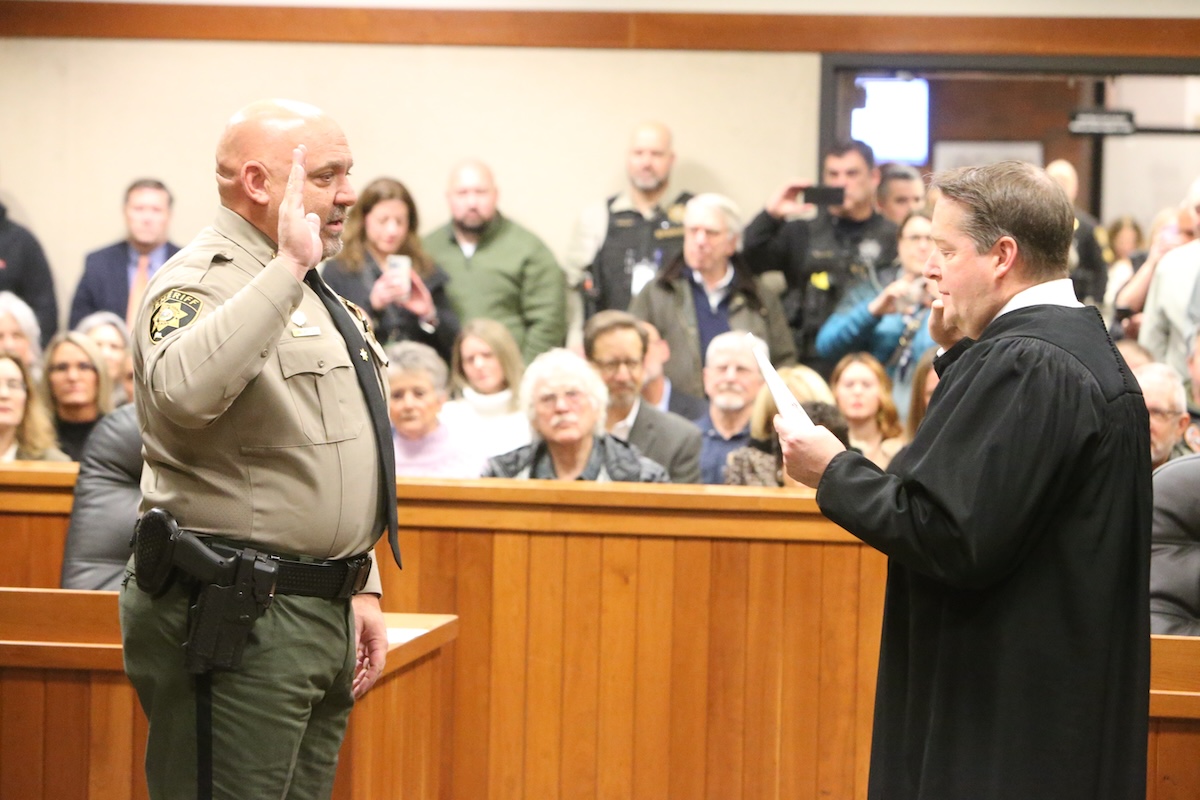

- (Joe Kline/Bulletin photo)

Jon Napier knew in law school that he wanted to work on business transactions, so he earned a master’s of business administration along with his law degree at Willamette University.

When he moved to Bend in search of small-town lifestyle in 2002, entrepreneurship was strong, but Napier said he didn’t foresee the influx of venture capital or the growth of the technology sector. Now, he regularly advises early-stage companies on securities law as they try to raise money in the private market, and his firm Karnopp Petersen is marketing its expertise in “emerging business” law to clients in other Oregon metro areas.

Napier talked recently with The Bulletin about guiding one of Bend’s largest law firms. Responses have been edited for length and content.

Q: Karnopp Petersen named you chairman of the partnership early this year. How does that role differ from managing partner, which is more common for law firms?

A: We have seven partners. Our thought is really we function like a board of directors. The partners are all involved in the decision-making process, as opposed to having a managing partner. It’s a collaborative process internally. My role as partnership chair is just to help facilitate that.

Q: What business strategies have you brought to the partnership?

A: One of the things I’ve been focused on, and it’s partly because of my practice, is the information economy in Bend. I got here in 2002. It’s changed. We have a much more diversified economy. Basically, from our perspective, innovation is key for Central Oregon’s future.

Q: You’ve built specialty practices around intellectual property, securities law and natural resources. Where do you see the firm in five years?

A: I would expect more specialization. We would continue working with local businesses but also involving ourselves in our regional business, outside of Central Oregon. We work in other areas of the state, Northern California, Washington. There’s lots of entrepreneurs around the state that are outside the Portland metro area. So we’ve been intentionally targeting folks who work in other areas of the state. Bend is just centrally situated in the state. We’re just ideally situated to deal with more sophisticated issues. And it does matter where you’re located.

Q: Your specialize in business transactions. What kind of work are you doing lately?

A: We’ve seen significant numbers of local companies being purchased. Most of these (acquisitions) fly under the radar. I don’t have permission from clients to get into details.

Q: What do these businesses have in common?

A: It’s a scalable, traded-sector business that’s growing, and therefore has become an acquisition target.

Q: Do you ever find it difficult to understand a client’s business or product?

A: We focus on understanding the law and helping translate that to our clients. One of the most important things for an attorney is to be a good listener. There are clients that do have complex products and businesses. It really is important to listen and understand and ask questions to help make sure you understand your client’s business. And it’s critical to understand, what do they want? What is their goal? If you don’t assess that, there’s a risk of having a misalignment of what the adviser thinks they should do and what they want.

Everything else tees off of it.

Q: Karnopp Petersen sponsors the Economic Development for Central Oregon Pubtalks, where you talk about changes in securities law. What’s been the most fundamental change in raising capital?

A: My take is the public markets, IPOs (initial public offerings), things like that, just aren’t working very well. So there’s a lot of pressure on business to open up the private markets, which would be private placement transaction. It’s private between issuers and interested investors.

Q: Among all the changes to federal rules and Oregon law meant to loosen restrictions on raising private capital, which ones do companies take advantage of most often?

A: I’m seeing more and more 506(c) activity. It’s a private exemption that allows advertising and general solicitation. The traditional exemption, the 506(b) exemption… we see 10 of those for every 506(c) rule.

There are still some restrictions. As an example, a 506(c) offering, there are strict rules on determining whether an investor is accredited or not. It’s perceived as safer and more well-developed to just stick with traditional securities processes and fundraising.

—Reporter: 541-617-7860, kmclaughlin@bendbulletin.com

What: Karnopp Petersen LLP

What it does: law firm

Pictured: Partnership Chairman Jon Napier

Employees: 32

Website: https:// karnopp.com/