Rising Rates and Tax Reform

Published 12:00 am Saturday, April 14, 2018

- Rising Rates and Tax Reform

After several years of low interest rates and steady growth, 2018 may be a year of change in the mortgage market. We talked with Mitch Wilcox from CMG Financial, Larry Wallace from Caliber Home Loans and Derek Meyer from Prime Lending about what they are seeing in the market.

How do you think rising interest rates will impact the Central Oregon Housing market?

Wallace: Raising rates will bring refinances to a crawl. Purchases initially slowed a little as rates moved up, but that was also our cold months. Purchase activity has picked up since the beginning of the year and we expect purchases at about the same volume as last year. Most of what drives a home purchase is a person’s confidence in their paycheck. People are generally very confident and that overcomes most of the impact of raising mortgage rates.

Meyer: We enjoyed some great equity gains over the last 10 years here in Central Oregon. In the mortgage segment, our rates are primarily fueled by treasury bills. They have continued to sell at low to modest gains. With the feds raising the prime rate borrowing money becomes tighter.

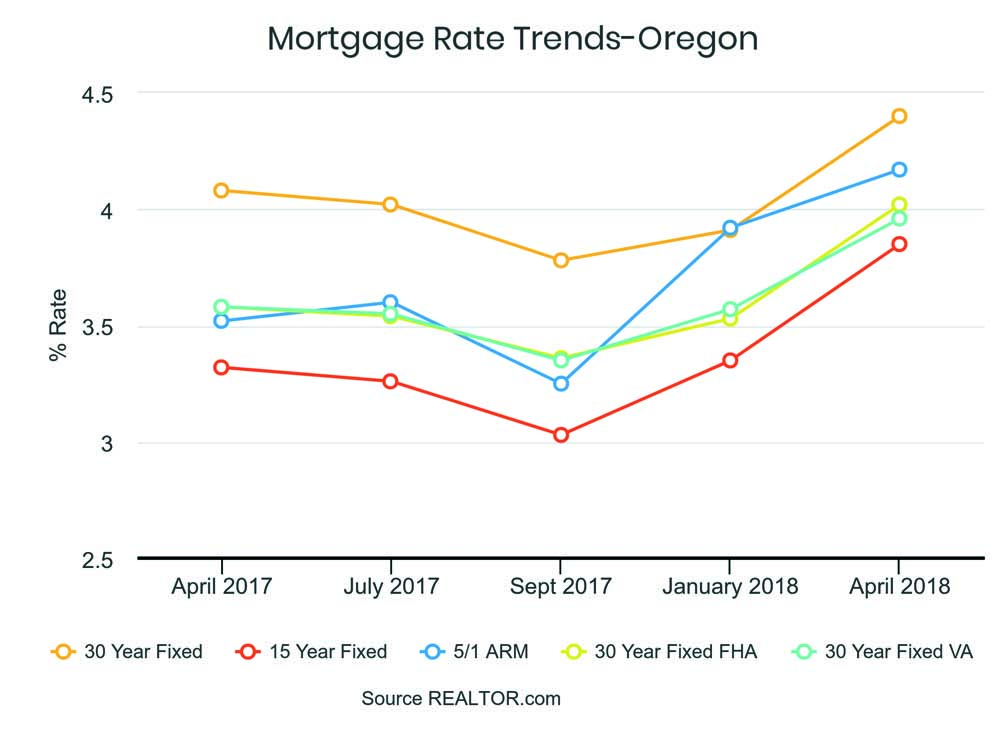

Rising interest will have an impact on the housing market. Take a look at the average interest rate since 2012 to show an example of what a $300,000 loan looks like (see graph below).

I do believe we will have a good year mainly due to the high housing demand in Central Oregon.

What do you think the implications of the federal tax overhaul will be on those looking at loans this year?

Wilcox: While helpful to some degree for families, I do not anticipate the tax cuts having significant impact for the economy, or long-lasting, impactful help for families relative to mortgage financing-the savings just aren’t enough. I will be interested to see if Trump policies truly find ways to make up the lost tax revenue. The tax overhaul has had mixed results; I’m not certain enough time has passed to accurately measure its effectiveness this year. Time will tell.

Meyer: Let me open with this I am not a CPA, so this is purely my opinion. There are some positives to the tax overhaul, but there are some negatives as well.

With mortgages there was not a change with 1030 exchanges and mortgage interest on primary and second homes is still deductible (up to $750,000, down from $1 million). You may still write off the interest on rental properties as well. You may still avoid capital gains tax if you live in the property two out of the last five years. For those of you that think the law changed to five of the last eight year-good news. That didn’t pass!

What has changed is home equity loan interest is no longer deductible. Instead of a HELOC to improve your home, it might make more sense now to do a cash-out refinance or a renovation loan.

It will be interesting to see how the tax overhaul rolls out. State and local tax deductions on property taxes, mortgage interest deductions, and monitoring itemized deductions might prove fruitful. But I imagine for most here in Central Oregon the standard tax deduction ($12,000 individual, $18,000 head of house, $24,000 married filing jointly) will be the main path.

I believe here in Central Oregon we will see very little impact on home loans with this new bill. Our average sales price for primary and second homes will not push that envelope far enough to make a significant dent in housing.

Let me end with, I am not a CPA. If you have more questions I would certainly contact one!

Any interesting lending trends you are seeing for 2018?

Wilcox: For much of the country, and particularly in Central Oregon, supply and demand issues will continue to impact our real estate economy. Given land-use restrictions, and with more housing demand than supply, we will continue to see values creep up.

Wallace: The increase in rates, while anticipated for the last five-plus years, is causing some consolidation in the mortgage industry. Lenders that had too much of their business in refinances (as opposed to purchases) are now in financial trouble and are for sale.

We are seeing purchase volume take a big shift away from banks and into the hands of independent mortgage bankers. Real estate agents refer a lot of purchase business and these agents prefer an established, local, non-bank, direct mortgage lender.

Working with the right team is crucial for the home buying and selling experience. Visit coar.com for a full list over 100 lending professionals that serve the COAR membership and their clients.