Oregon health insurers propose rates for 2019

Published 12:00 am Thursday, May 17, 2018

- Oregon health insurers propose rates for 2019

New rate filings from Oregon health plans suggest the individual insurance market is stabilizing, but consumers may still face significant premium increases next year.

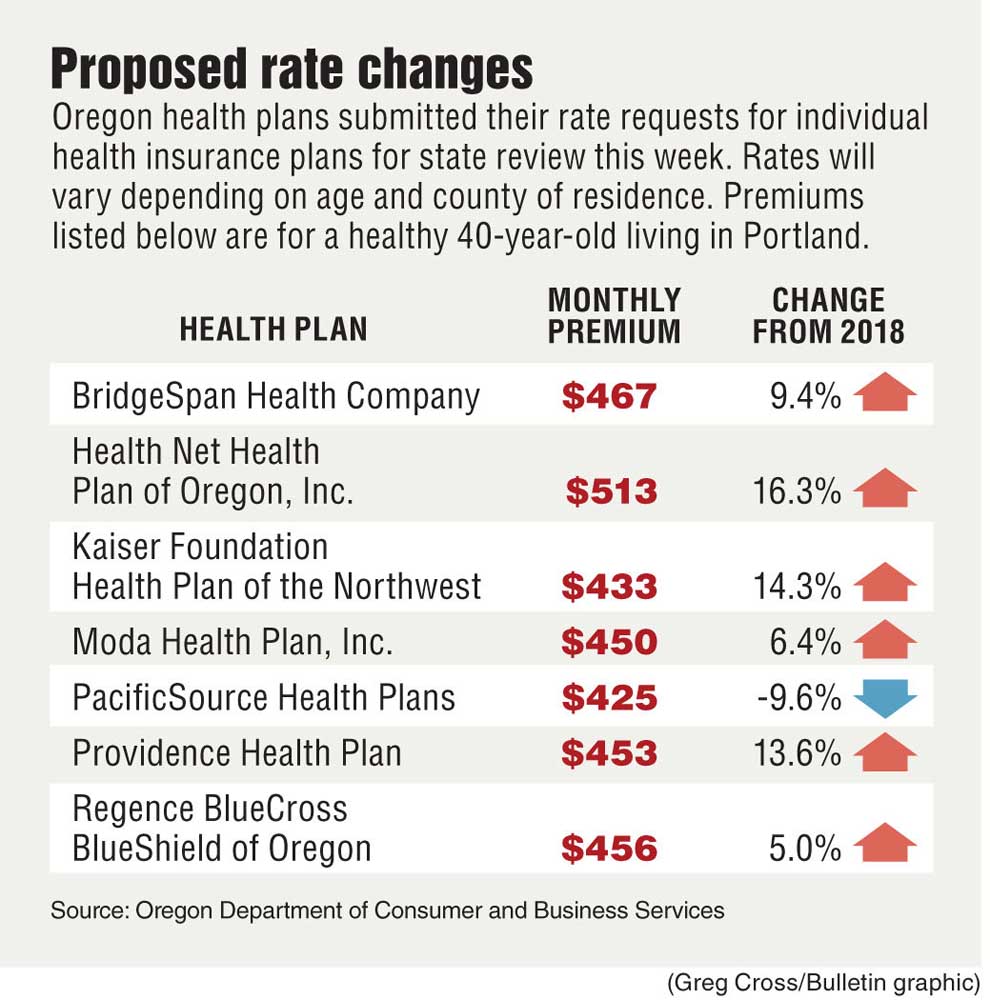

Six of the seven insurance plans requested 2019 premium increases of 5 percent to 16.3 percent over 2018 rates. That’s only slightly lower than the 6.9 percent to 20.7 percent range requested last year.

Trending

The major outlier in the group was PacificSource Health Plans, which dominates the Central Oregon market and proposed cutting its premiums 9.6 percent. The premium requests reflect what a healthy 40-year-old in Portland would pay for coverage. Actual costs will vary for consumers in different age groups or counties.

The rate requests will now be reviewed by state officials, a step that could raise or lower the premiums requested by the end of June. Final rates will be issued on Aug. 15.

“It is troubling that the two insurers with the biggest market share, Providence and Kaiser, are proposing big increases,” said Jesse O’Brien, policy director for the Oregon State Public Interest Research Group. “If they are approved, it will be disruptive for consumers. Regulators definitely need to break out their red pens.”

Last year, the final rates were generally lower than those the insurance plans had requested.

The rate changes apply to nearly 200,000 Oregonians who buy individual health plans either on or off the state’s health insurance exchange. The premium increases wouldn’t affect most Oregonians, who are covered by large group plans or companies that self-insure.

The health plans serving the small group market, which includes companies with fewer than 50 employees, requested premium changes ranging from a decrease of 4 percent to an increase of 9.4 percent.

Trending

State officials said the rate filings suggest that Oregon’s insurance market is stabilizing.

“What the numbers have shown is a bit of equalization,” said Andrew Stolfi, the state insurance commissioner.

In 2015, Oregon health plans lost a combined $217 million, but pared losses to $35 million in 2016. For 2017, they had combined net profit of $195 million. All seven plans offering individual plans in 2018 maintained their coverage areas for 2019. Two plans expanded into new counties, including PacificSource, which will now offer plans in Lane and Yamhill counties.

Consumers in all 36 counties will have a choice of plans for 2019. Deschutes County residents will choose among four plans, while Crook and Jefferson Counties will choose among six.

PacificSource officials said focusing on markets in Central Oregon and the Portland area where they had good relationships with providers helped to improve management of high-risk patients with complex health care needs.

“I think we found that approach has worked,” said Ken Provencher, PacificSource president and CEO. The company also saw a better mix of healthier and sicker patients that spread costs across a broader range of patients, and allowed the company to bounce back with better performance after two high-cost years in 2014 and 2015.

“We thought that gave us some room to make those changes in our rate,” he said.

The rate requests reflect a number of recent changes on both the federal and state levels. As of 2019, Congress has eliminated the individual mandate, which requires people to buy insurance or pay a penalty. Insurers expect those who choose not to buy insurance to be healthier than average, leaving a less healthy, more costly group of patients in the insurance pool. Insurers raised their premium requests between 1.2 percent to 11.5 percent to account for those higher costs.

Provencher said PacificSource has not seen many people drop insurance coverage after the individual mandate was repealed, and so didn’t factor in as big of an adjustment.

“I almost have the feeling, unfortunately, maybe, but maybe for the benefit of the market, the market has become somewhat used to some of the disruptions that we’re seeing,” he said.

The Trump administration also eliminated funding for cost-sharing help provided to low-income people starting in 2018. But Oregon and many other states instructed insurers to load the cost of that cost-sharing help on to silver level health plans, which are used to calculate the amount of federal subsidies offered to consumers on a sliding scale. The net result was an increase in federal subsidies, which many consumers used to buy free or nearly free bronze plans, or gold plans, which provide better coverage, at a lower cost.

Oregon officials again instructed health plans to include the cost sharing in their silver plan premiums for 2019. However, officials from the federal Centers for Medicare & Medicaid Services have indicated they are considering requiring states to spread the cost sharing across all plans. That could lower silver plan premiums and the resulting subsidies available to consumers.

Oregon also passed a reinsurance program to spread the risk of high-cost patients across all health plans. That helped to reduce premiums by about 6 percent for 2018.

“Although the proposed rate hikes are lower on average than in recent years, in part due to the success of the reinsurance program, this still does not look like the picture of an entirely healthy and stable market to me,” O’Brien said. “I think Oregon policymakers should seriously consider additional efforts to stabilize this market.”

Oregon Sens. Ron Wyden and Jeff Merkley, both Democrats, responded to the rate increases with a terse statement blaming the administration and Republicans in Congress for trying to undermine the individual health insurance market created by the Affordable Care Act.

“Despite Oregon’s efforts to stop the Republican campaign of health care sabotage, families are still facing premium increases,” Wyden said. “Oregon banned Trump’s proposal for junk plans and adopted a forward-thinking State Innovation Waiver that will help keep costs down, but Oregonians are still paying too much for health care. Trump’s attempts to undermine the individual health care market on behalf of special interests instead of working on a bipartisan basis to make health care affordable are coming at the expense of Oregonians.”

Merkley blamed the president for double-digit premium increases across the country.

“Oregon has done everything it can to push back at the state level, and Oregonians are seeing much lower premium increases than many other Americans,” he said. “These rising costs are still too high, though, and we need to take on health care affordability and the skyrocketing drug prices that are helping to drive premium increases.”

—Reporter: 541-633-2162, mhawryluk@bendbulletin.com