Oregon knocks down health plan rate hikes

Published 12:00 am Saturday, July 21, 2018

- Oregon knocks down health plan rate hikes

Oregon state officials announced the final 2019 premium rate increases for individual and small-business health insurance Friday, lowering most of the rate hikes requested by insurance companies for individual plans by 5 to 6 percentage points.

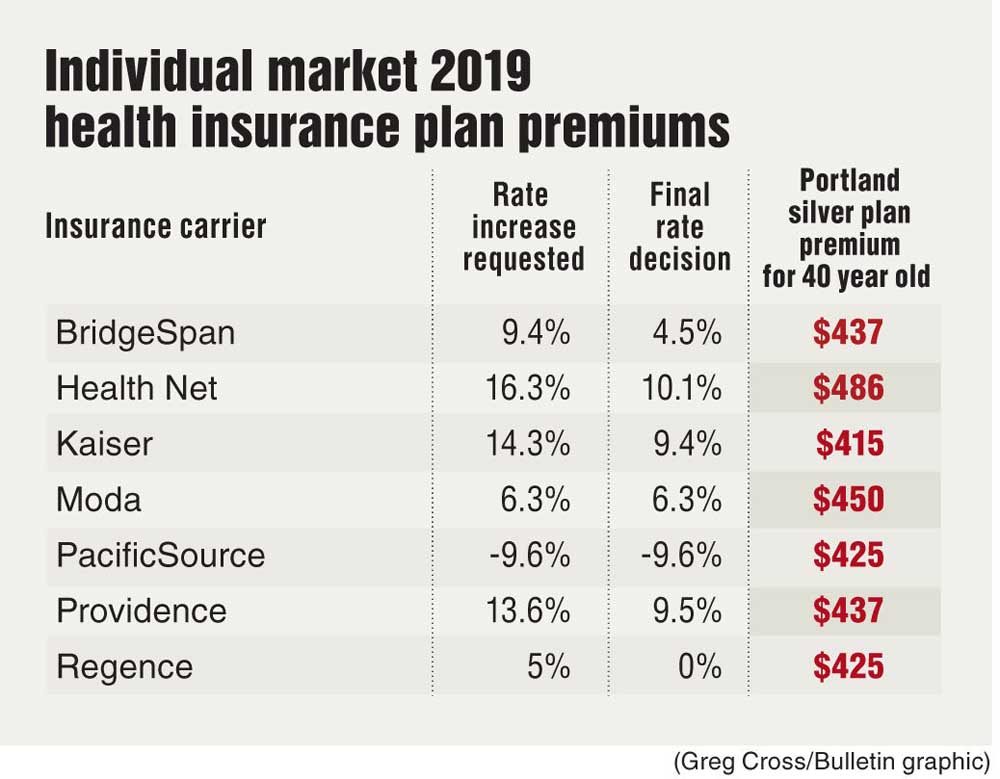

Of the seven carriers offering individual plans in Oregon, six had requested premium increases of 5 to 16.3 percent. Insurance regulators in the Department of Consumer and Business Services knocked those down to no more than 10.1 percent, and in one case to zero.

Trending

PacificSource Health Plans had filed to decrease its premiums by 9.6 percent, and the regulators granted that request. Only Health Net will have a double-digit increase, although that plan serves only 550 individuals statewide this year.

“I was expecting things to be a lot worse,” said Mark Griffith, a health care advocate with the Oregon State Public Interest Research Group. “Considering the uncertainty in the marketplace that’s being created by federal policy recently, I was expecting a lot more increases in the double digits, and maybe even approaching 20 percent based on what we’re seeing in other states.”

In June, the consumer watchdog group had questioned why Providence Health Plan, which covers 90,000 people with individual plans, was requesting a double-digit rate hike for the third year in a row. Regulators reduced the requested 13.6 percent increase to 9.5 percent.

“That really shows that the rate review process is doing very good work and preventing increases in premiums that are not justified by the circumstances,” Griffith said.

Premiums for a standard silver plan for a 40-year-old in Portland in 2019 will range from $415 to $486 per month next year, not including any subsidies that might be available through the health insurance exchange. In 2018, Oregonians who qualified for subsidies paid an average premium of $138 per month.

Premiums for each county will be announced in August. Rates differ from county to county based on the contracts plans establish with local providers and other differences in costs. Open enrollment for 2019 coverage runs from Nov. 1 to Dec. 15. The rate increases do not affect employer-sponsored group plans, which cover the vast majority of Oregonians.

Trending

Premiums for the small group market range showed more stability, ranging from a decrease of 4 percent to an increase of 7.2 percent.

The new rates suggest Oregon’s health insurance marketplace is stabilizing. After losing money in 2015 and 2016, insurance companies in the state posted a net income of $195 million in 2017.

“The numbers are coming down and things appear to be getting more stable,” Insurance Commissioner Andrew Stolfi said. “The rates are getting closer together … There is less of a difference between the high and low (premiums).”

Rate requests go through a rigorous review process, which includes public hearing and a public comment period. Regulators then analyze the plans’ claim history and projections to make sure that rates will adequately cover health care costs for their members, without being too high or too low.

The regulators disagreed with the insurance companies on how much three factors would impact their costs next year. Stolfi said the carriers underestimated the impact of a reinsurance plan implemented in Oregon last year that will reduced premiums by 6.3 percent.

Second, carriers overestimated the effect of the Trump administration eliminating cost-sharing subsidies for low-income consumers and subsequent efforts by the state to shield buyers from those costs. And third, plans tended to overestimate the impact of changes at the federal level that are creating uncertainties in state insurance marketplaces. Eliminating the individual mandate to purchase insurance, and creating new types of limited-coverage plans could siphon healthier consumers away from exchange plans, leaving them with sicker, more expensive members.

“If it wasn’t for all this federal uncertainty, the rates would be even lower for Oregonians,” Stolfi said. “We’re hopeful to see that uncertainty end.”

Charles Gaba, who tracks exchange enrollments under the Affordable Care Act on his site, ACAsignups.net, estimates that without actions taken by the Trump administration to undermine the exchanges, Oregon premiums in 2019 would have risen less than 2 percent.

— Reporter: 541-633-2162, mhawryluk@bendbulletin.com