Retailers add features to lure holiday shoppers into stores

Published 12:00 am Sunday, November 25, 2018

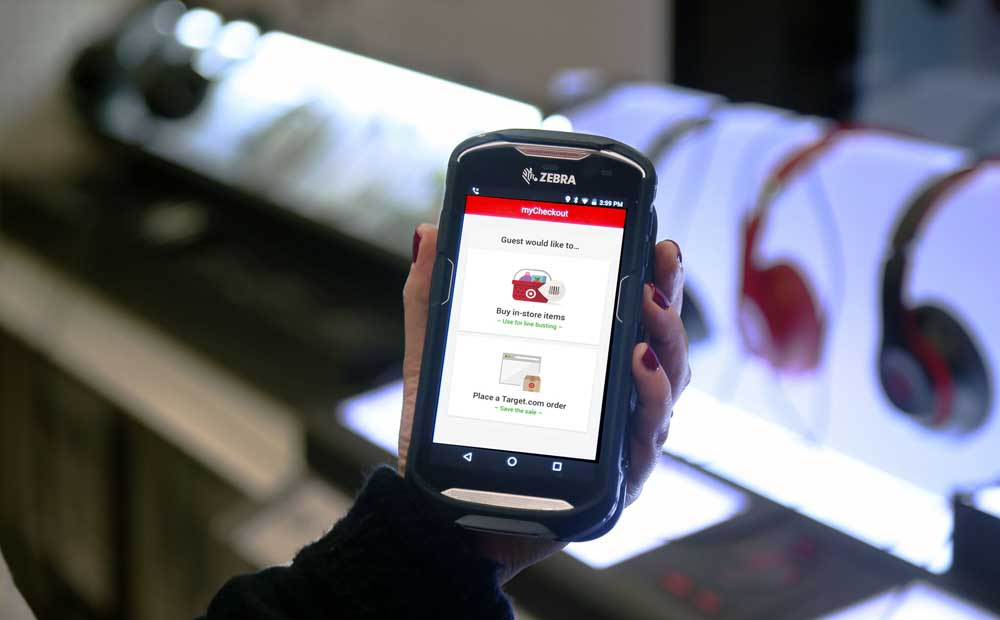

- Retailers are using mobile-checkout devices to make shopping at stores more convenient this holiday season. (Target Corp./TNS)

Major retailers are arming to do battle with internet mega-merchants during this holiday shopping season using a key strategy: Be less annoying.

Forced to adapt to the steady incursion of online spending, brick-and-mortars are implementing features to draw more shoppers and gain market share as the buying reaches full force for the holidays.

Trending

Heavy price-reduction no longer cuts it when consumers know they can avoid crowds by shopping online. Some retailers are addressing the most bothersome aspects of hitting the malls, such as long lines and heavy packages.

Retailers including Target Corp., Walmart Inc. and Macy’s have introduced “skip-the-line” technology, where employees help shoppers pay and check out from anywhere in the store.

Many have expanded two-day free shipping for online orders on their websites and are pushing the use of pickup services in which shoppers order online and retrieve their goods at the stores — and, the chains hope, shop for extra items once they’re inside.

Walmart rolled out a mobile app that shows shoppers where products are located in its stores, so the items can be found without asking for help.

“They’re all trying to streamline that experience and make it as close to the online one-click experience as they can,” said Deb Gabor, chief executive of Sol Marketing, a brand strategy consultant.

The long shopping weekend kicked off Thanksgiving Day, when many stores once again opened their doors for holiday shoppers.

Trending

That was followed by Black Friday, one of the busiest shopping days of the year and it ends with Cyber Monday, when the emphasis turns to online shopping.

An estimated 164 million people planned to shop in stores and online during the five-day period, roughly the same number as last year, according to a survey by the National Retail Federation trade group and Prosper Insights & Analytics.

About 116 million people, or 71 percent, planned to shop on Black Friday when heavy price discounts and promotions were widespread.

Mastercard is predicting the Sunday before Christmas, Dec. 23, might be as busy as Black Friday this season. Also, the span between Thanksgiving and Christmas this year, at 32 days, is the longest possible and squeezes in a fifth weekend.

The result: For all of November and December, retail sales will reach $1.002 trillion, a 5.8 percent increase from last year and the first time they’ll cross the $1-trillion mark, the research firm EMarketer estimates.

Even brick-and-mortar sales will rise 4.4 percent to $878.4 billion, and physical stores still account for 87.7 percent of total holiday sales, EMarketer said. The stores’ share of the retail market keeps declining; it was 91.7 percent in 2014.

Online sales will surge 16.6 percent this holiday season to $123.7 billion and amount to 12.3 percent of all sales during the season, EMarketer forecast.

It’s been well documented that conventional brick-and-mortar retailers failed to innovate fast enough to tackle the surge in internet shopping with its low prices and convenience.

Familiar chains have shuttered stores, posted massive losses and gone bankrupt as consumers shifted a rapidly swelling share of their spending to Amazon.com and other online sites.

Two of the recent casualties were century-old Sears Holdings Corp., which filed for bankruptcy last month, and giant toy retailer Toys R Us Inc., which liquidated earlier this year.

“The stores that are doing well are the so-called omnichannel stores, the ones that successfully combine brick-and-mortar stores with their online sales,” said Lisa Haddock, a marketing lecturer at San Diego State.

For this year’s holidays, traditional retailers are trying to make the in-store experience more appealing because the challenge is to keep shoppers coming into the locations even though checkout lines turn off many.

Indeed, in the survey taken by the National Retail Federation and Prosper Insights & Analytics, a majority 53.9 percent of the respondents said the main reason they would not shop over the Thanksgiving weekend was: “I don’t enjoy the experience.”

A study by UC Berkeley’s Sutardja Center for Entrepreneurship and Technology this year found that half of shoppers will avoid a store if it has long lines and, among those who do visit a store, one-third will leave without a purchase if they have to wait in line for more than seven minutes.

“We all know waiting in line is a massive pain,” Gabor said, and mobile in-store checkout technology and other steps are about “lowering the barrier to getting people physically in the stores.”

Walmart and Target will station employees throughout stores with hand-held check-out scanners and credit-card sliders, enabling shoppers to complete purchases without standing in lines. It’s a feature some retailers, such as Nordstrom Rack, already have in place.

Macy’s format, called Scan & Pay, is for users of its mobile app. Shoppers scan items as they shop, pay through the app and likewise avoid the checkout lines.

Target is offering free two-day shipping online with no minimum purchase or membership required. Walmart said it made “millions of items” from third-party sellers on its website available for free two-day shipping.

Electronics retailer Best Buy Co. is offering free shipping on everything ordered on its website, no minimum purchase required, through Dec. 25. Store pickup is free as well.

Kohl’s Corp., meanwhile, said products bought on its website — some of which aren’t usually available in its department stores — can now be shipped free to any of its 1,100 nationwide locations.

So does another Kohl’s feature that started a year ago: Some of its stores accept Amazon returns, which also drives more foot traffic to those locations.

Amazon isn’t sitting still, either. The online behemoth said during this holiday season, all customers “can shop hundreds of millions of items with free shipping, including products across the wide assortment of Black Friday deals, and for a limited time with no minimum purchase.” Faster shipping is available to Amazon’s Prime members.

Despite Amazon’s remarkable success, “many people still want to touch things” in stores before making a purchase and checking out and, if a store makes that experience easier, it will ring up more sales, Haddock said.

“Value to a customer is not just price but the cost of your time and your physical and mental energy going to into the stores,” she said. “The chains have to keep addressing those issues. That’s one reason why online does so well.”