Nvidia’s maiden 13F filing sends AI-focused tech stock soaring

Published 7:06 am Thursday, February 15, 2024

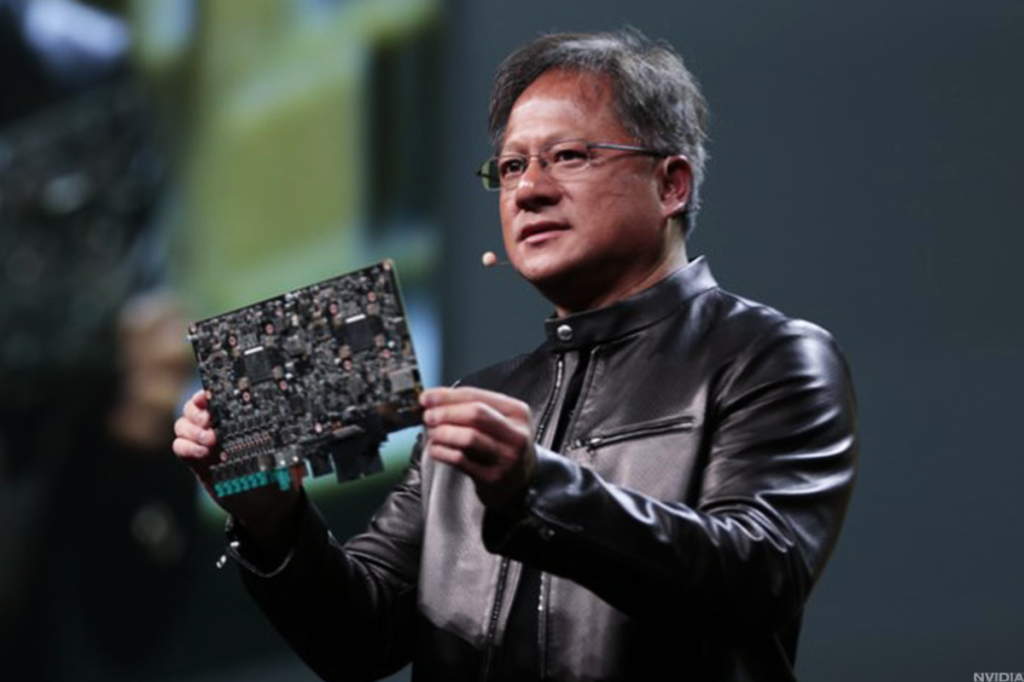

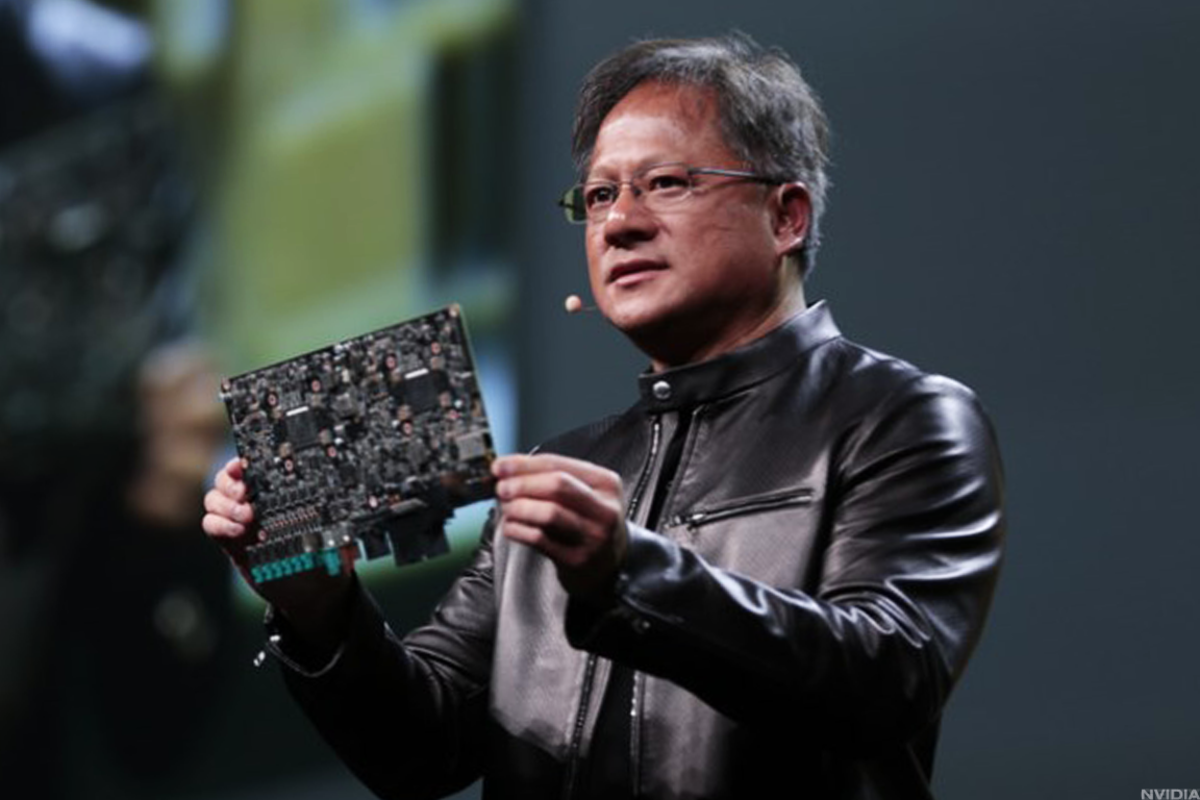

- CEO Jensen Huang is investing some of Nvidia's cash hoard in artificial intelligence companies.

Updated at 10:20 AM EST

Nvidia (NVDA) unveiled a surprise investment in a small tech group late Wednesday that underscores its bets on the broad reach that AI-related technologies are likely to have over the coming year.

Nvidia, which holds the market’s dominant position in artificial-intelligence-chip making under the leadership of CEO Jensen Huang, also runs a small portfolio of investments that, under Securities and Exchange Commission rules, require quarterly public updates normally reserved for hedge funds and large investment vehicles.

In the group’s first-ever 13-F with the SEC last night, Nvidia noted a small $3.67 million stake in SoundHoundAI (SOUN) , a Santa Clara, California-based tech group focused on its signature voice-activated AI platform.

Nvidia noted that it owned around 1.73 million shares of SoundHoundAI, following an original investment of around $75 million during a funding round completed in 2017.

Analyst Ives on SoundHoundAI: ‘positive indicator’

“We view this as a positive indicator for the company, as this investment now further solidifies the company’s brand within the AI Revolution,” said Wedbush analyst Dan Ives, who carries an outperform rating and $5 price target on SoundHound.

“With the Godfather of AI Jensen [Huang] and Nvidia now backing SoundHound, [we] believe this could be the start of a broader investment into the company down the line, which is a clear tailwind,” Ives added.

Related: Analysts unveil new stock price target for Nvidia ahead of earnings

Nvidia also noted its $47.3 million stake in chipmaking rival Arm Holdings, which it tried to purchase outright in 2021 for around $40 billion. The group listed on the Nasdaq in September in a $5 billion IPO and remains 90%-owned by Japan’s SoftBank.

Another stake detailed in the 13-F was a $76 million holding in Recursion Pharmaceuticals (RXRX) , which uses AI technologies in its drug-discovery process.

Other Nvidia holdings include medical-device group Nano-X Imaging (NNOX) and TuSimple Holdings, TSPH a tech company focused on full-self-driving technologies.

SoundHoundAI said last month that Jersey Mike’s, the Manasquan, N.J., sandwich chain, will use its voice-activated AI platform to help communicate with customers in taking orders and answering menu-related queries.

It can also “provide details about opening hours, parking availability and allergen information, and respond to frequently asked questions,” the company said.

Similar deals have been cut with Chipotle Mexican Grill (CMG) and Krispy Kreme (DNUT) .

More AI Stocks:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- AI stock soars on new guidance (it’s not Nvidia!)

- Big tech stocks are doubling down on AI

The group had revenue of $13.3 million over the three months ended in October, based on its last financial report, a figure that is estimated at around $18 million for the final three months of last year.

“With AI becoming increasingly more popular, the company is experiencing many inbound leads as the dynamic finally starts to shift in terms of AI usability,” Ives said.

Related: Nvidia hits major milestone as AI hype shifts eyes to earnings

“We continue to believe that SoundHoundAI is in a strong position to capture its fair share of the AI chatbot market demand wave in 2024 and beyond with its technology providing more use cases going forward,” he added.

SoundHoundAI shares were marked 54% higher in early Thursday trading and changing hands at $3.48 per share, a level that would value the group at around $890 million.

Related: Veteran fund manager picks favorite stocks for 2024