Oregon homeowners face soaring premiums, few property insurance options over wildfires

Published 12:15 pm Monday, February 26, 2024

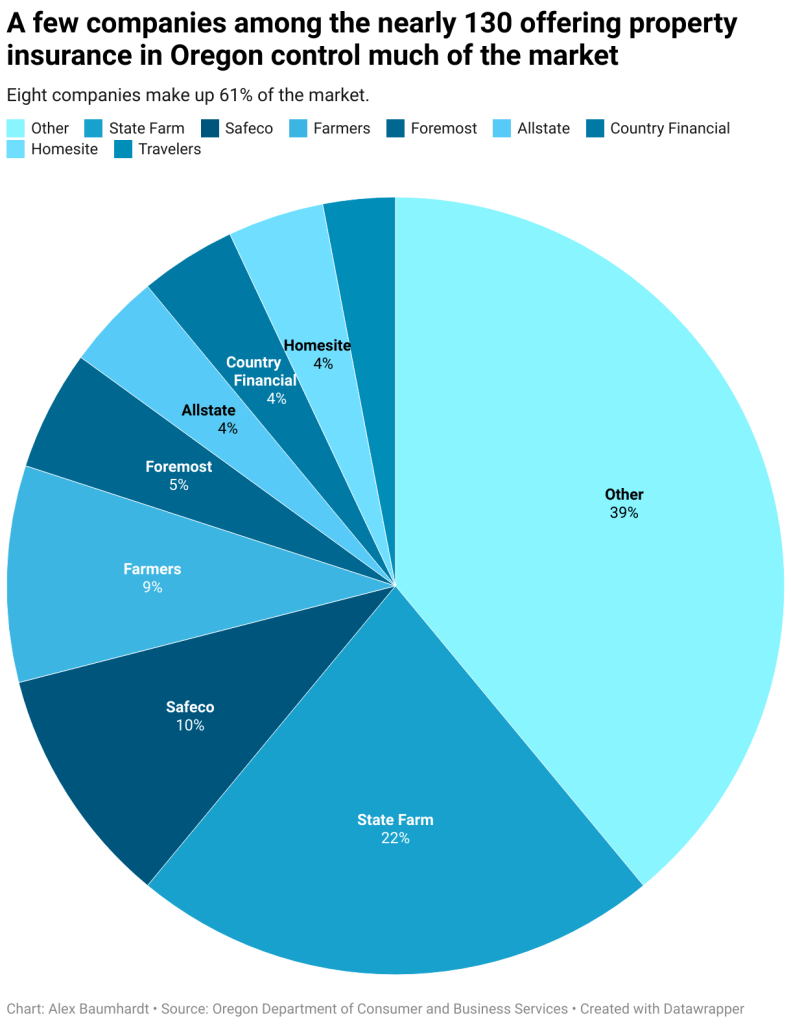

- Oregon insurers

Nancy Matela co-owns a vacation home in a wildfire zone northwest of Bend that has a new, annual property insurance premium of $9,000. It’s more than nine times what the company Safeco charged her a year ago.

That policy remains her only option as well: Her broker couldn’t find her another one.

Matela is among a growing number of homeowners in Central, Southern and Eastern Oregon who have faced higher annual premiums or had their policies canceled when they came up for renewal, with some insurers no longer writing new policies. That change came after the 2020 Labor Day fires destroyed more than 4,000 homes, becoming the state’s most expensive natural disaster in history, according to state and federal emergency response agencies.

Since then, insurance markets in parts of Oregon have begun to look more like those in California, where some of the largest insurance companies in the country are no longer renewing or writing new policies, and where the number of people turning to a state-backed insurer of last resort has doubled in recent years.

“If you want to know what the next five years look like in Oregon, look at Southern California,” said Perry Rhodes, who has sold property insurance policies for Farmers in Bend for the last two decades. “If you want to know what this looks like if things get even worse, look back east to Florida,” he added. Farmers announced last year it would limit new property insurance policies in California and no longer sell any new property policies in Florida.

Rhodes said it used to be extremely rare to find a customer whose property was at such a high risk that he had to refer them to other companies. Now, he said, he sends about half of potential customers to other insurers because Farmers won’t cover them.

“The only homes that we know for sure are going to be eligible are the ones that are, so to speak, right in the middle of town, and right next to the fire department,” he said.

Oregon’s insurance commissioner, Andrew Stolfi, told the Capital Chronicle the exodus of companies offering coverage in parts of Oregon is not as severe as in California, which has been driven by high payouts for recent wildfire losses and state consumer protection laws that previously capped annual insurance premium hikes.

Nevertheless, Oregon lawmakers are aware of the predicament. But recent laws passed by the Legislature to encourage insurance companies to reward customers for hardening their homes and communities against wildfires have had little impact so far, according to more than a dozen policyholders, agents, brokers and industry leaders.

State Sen. Jeff Golden, D-Ashland, who’s been behind several wildfire proposals, and industry and fire experts said investing in fire-resistant roofs, siding and clearing out vegetation to make communities resilient and accessible to firefighters are the only options to bring insurers back to parts of the state and curb rising premiums.

In the current session, Golden is behind Senate Bill 1511, which would create a one-time $5 million grant program to help Oregonians establish neighborhood protection groups focused on creating and managing defensible space around homes to help fight a wildfire and clearing yards of debris. It would also begin the process of creating a state-backed certification program for wildfire prevention for homes and neighborhoods, to encourage insurers to continue writing policies and to slow rising premiums.

“Absent that, I’m not seeing an obvious path to a viable insurance system for wildfire in the state. If somebody’s got alternatives, I’d like to hear it,” he said.

Golden helped secure over $30 million for home hardening in 2021. But in 2023, the Legislature allocated about 10% of that.

Rising premiums

In Oregon, premiums are up an average of nearly 30% since 2020, according to the state’s Department of Consumer and Business Services. It reflects nationwide increases, according to several insurance marketplace reports. But in Bend, Ashland, Medford and Hood River, agents said premiums for most people have doubled or quadrupled due to the wildfire risk, and policies under $1,000 per year have become extremely rare.

Agents said policies on some homes near Ashland have risen as much as 600% in the last four years.

Homeowners in Jackson, Hood River, Deschutes, Umatilla and Malheur counties also say they’ve never seen premiums so high.

“Insurers are having to reckon with the fact that there has been a dramatic increase in natural disaster related losses,” said Kenton Brine, president of the Seattle-based nonprofit industry group NW Insurance Council.

He said this has to do with climate change and where people have chosen to build.

“Companies either have to reduce their risk exposure in order to reduce the threat that a major wildfire will wipe them out, or they have to increase premiums, or they have to do both,” Brine said.

He added that companies are also adjusting premiums that have been artificially low in Oregon for years and have not kept up with rising inflation. He said they are also accounting for a reluctance by reinsurance companies, which insure insurance companies, to cover those that sell high-risk home policies.

Quiet retreat

No major insurer has publicly announced a retreat from Oregon as they have in California, Florida and Louisiana, which have all been slammed with repeated natural disasters. But several companies that used to sell property insurance in Oregon and across the West and the U.S. no longer offer it at all. Oregon Mutual and Kemper have stopped selling property insurance, and Nationwide no longer sells one of its property policies for high-value homes.

But a quiet retreat is occurring piecemeal in Oregon, as companies choose to no longer renew or write new policies in some ZIP codes.

Insurance brokers and agents in a dozen interviews told the Capital Chronicle that policies they could have written a year ago for new or renewing customers are declined by insurance companies today. In Central Oregon, brokers said Safeco — the state’s second largest insurer — as well as Progressive are effectively no longer writing new policies in certain ZIP codes in and around Bend, Sisters and Sunriver. One said Safeco is not writing new policies on properties over $1.5 million in Redmond, too.

Glenn Greenberg, a spokesperson for Safeco and Liberty Mutual, which owns Safeco, said in an email that the company does not publicly discuss its underwriting guidelines or business decisions, but continues to write new policies in Oregon.

“We do not have any town- or city-wide restrictions for new business in the state,” Greenberg wrote.

Ron Davis, a spokesperson for Progressive did not respond to questions about specific areas where brokers and agents said the company was declining coverage.

“While we have taken some actions in Oregon to help manage risk, we continue to write business throughout the state,” he said in an email.

In Ashland and Medford, brokers selling insurance policies for Travelers, Nationwide, Capital Insurance Group and Sublimity said it was nearly impossible to get the companies to underwrite new policies outside of the cities and in rural areas.

Limited authority

Oregon law requires insurers to include fire coverage in home insurance policies, but it does not prohibit insurers from not renewing policies or choosing not to insure properties due to a wildfire risk.

Stolfi, the insurance commissioner, said he has little regulatory authority when it comes to rising premiums or who gets covered. Actuaries — professional risk assessors — review policies and requests to raise premiums from insurers in Oregon, but mostly to ensure they comply with state and federal laws.

Some insurance agents said they are waiting for Oregon to follow California, and to allow insurers to offer home policies in high-risk areas that exclude coverage for wildfires. Instead, property owners could buy an additional policy meant to cover wildfires from Lloyd’s of London, a marketplace of insurers that share risk, or from the state-backed plan of last resort.

Policies under the Fair Access to Insurance Requirements plans cover some damage or loss on properties that are considered too risky for companies to insure. They exist in more than half of states and are subsidized by taxpayers and insurance companies. They often come with higher-than-average premiums and less coverage. Oregon’s Fair Access to Insurance Requirements plan will only pay up to $600,000 for damage or loss.

Demand for such plans in California has doubled in the last four years and now covers 3% of all California property owners.

In Oregon, Fair Access to Insurance Requirements plans cover just a tiny fraction of the market: about 1,700 homes, farms and commercial properties, down from a high of 2,000 a decade ago. But the number of new applicants rose last year to 500, compared with 168 in 2020.

That trend could continue. Brokers and insurance experts doubt the market will improve much.

“Carriers are just not interested in writing new business or growing,” said Greg White, owner of Reinholdt & O’Harra Insurance in Ashland.

He said typically the market rebounds, but he fears it might not this time.

“I don’t know that we’re gonna get out of this one. This one is different,” he said.