Presidential election a fork in the road for automakers’ EV plans

Published 5:25 am Monday, February 26, 2024

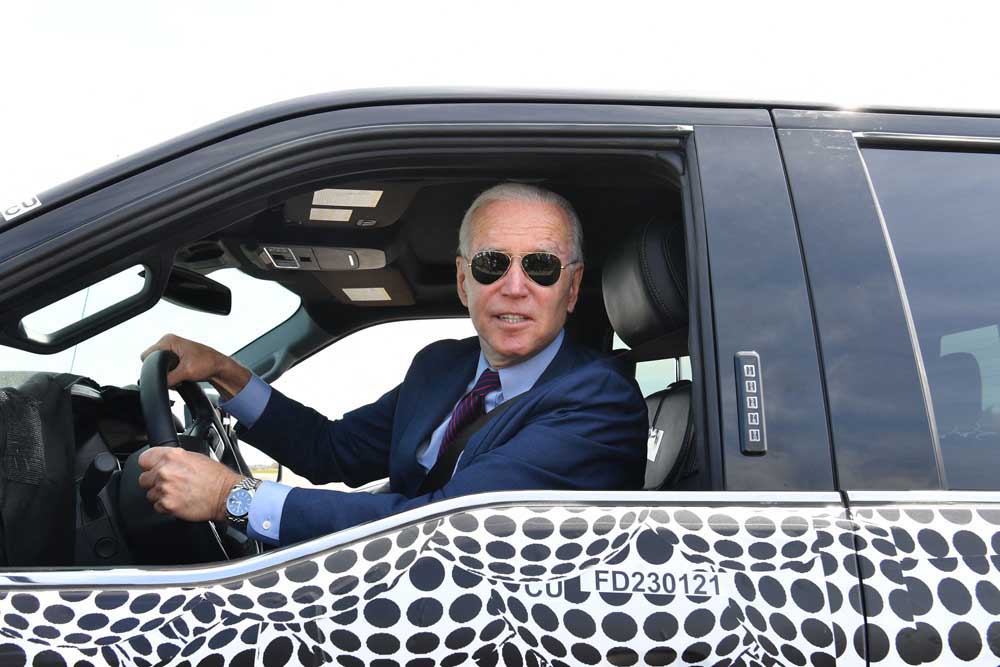

- U.S. President Joe Biden drives the new electric Ford F-150 Lightning at the Ford Dearborn Development Center in Dearborn, Michigan on Tuesday, May 18, 2021. (Nicholas Kamm/AFP/Getty Images/TNS)

Depending on whom Americans elect to the presidency in November, the U.S. auto industry could be looking at two vastly different product and profitability scenarios.

As a result, the industry is holding its breath. The Biden administration last year proposed stricter emissions regulations into the next decade, suggesting EV penetration would need to be close to 60% by 2030 for manufacturers to comply. A forecast from business analysis firm GlobalData Plc expects even under that scenario, EV adoption would be around 48% by 2030, while it might be more like 32% under former President Donald Trump, who has promised to strip back requirements and revoke California’s waiver to set its own rules if he returns to the White House.

“Over the last decade or so, CO2 legislation has become such a divisive topic between Republicans and Democrats,” GlobalData forecaster Kevin Riddell said. “Having an inconsistent policy makes it tougher for the OEMs and suppliers to plan for all for this, to bring the economies up, and to start actually making profit off these things.”

Disagreements on policies that encourage EV adoption have been fodder for attacks between the candidates. Trump calls President Joe Biden’s proposed emissions rules an “EV mandate” that will kill jobs because EVs have fewer parts and consumers aren’t ready to switch. Biden says if Trump were to roll back standards, the United States would lose auto jobs to China and face negative climate impacts.

Another Biden term would pressure automakers to invest in more EV capacity and battery production as well as pursue low-cost EVs, especially in light of increasing foreign competition and consumer hesitation, Riddell said. To what extent will depend on the final rules expected out next month, though reports suggest the planned 2030 targets will be pushed out.

Meanwhile, a second Trump administration would bring greater profitability for automakers, Riddell said. Based on already-announced investments, the EV sales mix will increase.

But with less regulatory pressure, traditional automakers could lean on their profitable internal combustion engine vehicles for longer, producing more tailpipe emissions.

One thing is certain: A majority of Americans aren’t buying EVs. Fully electric models represented 7.6% of new vehicle sales in the U.S. last year, up from 5.9% in 2022, according to Kelley Blue Book estimates. That growth, though, is slowing, as consumers are reluctant to pay the premium prices early adopters have been.

The average transaction price on a new EV last year was more than $61,700 compared to $47,450 for other models, excluding any applied consumer incentives, according to auto information website Edmunds.com Inc. Automakers late last year announced EV-related capacity cuts, nixed programs and delayed launches.

“You need an ecosystem for this to work,” said Sam Abuelsamid, principal e-mobility analyst at market research firm Guidehouse Inc. “You can’t just build the vehicles and hope for the best. You actually have to address every aspect of that ecosystem — charging, the battery manufacturing, the mineral sourcing, the whole supply chain, and the recycling at end of life.”

What’s at stake

The lagging EV ecosystem threatens automakers’ ability to comply with regulations, particularly under Biden’s accelerated schedule, which could jeopardize profitability. Automakers like General Motors Co. are calling for more flexibility. The Detroit automaker is predicting positive variable profit on EVs this year, Chief Financial Officer Paul Jacobson said this week.

“You’ve got to make sure that you don’t get into a position where we’re forcing adoption on people,” he said at Citibank NA’s Global Industrial Tech and Mobility Conference. “The more we focus on trying to use the regulatory environment to drive adoption, that can get a bit dangerous, because that’s ultimately what leads to overproduction and having to incentivize to push those vehicles out and really hindering profitability.

“Slowing that adoption down and still achieving the goals, working proactively with administrations to make sure that we’re looking at it from the consumer data as well as trying to drive adoption, is the ultimate compromise.”

GM’s strategy also revealed some unintended consequences of emissions rulemaking. The automaker backtracked on its “all in” on EVs plan, announcing it’ll introduce plug-in hybrids to its lineup to comply with regulations because EV demand isn’t where the company had hoped.

The Biden administration may scale back a final Environmental Protection Agency rule from its proposal made last year to reduce tailpipe emissions by 56% from new cars, SUVs and trucks between model year 2027 and ‘32, according to reports from several news outlets. The EPA rule would work in concert with a proposed National Highway Traffic Safety Administration rule that sets vehicle fuel economy standards.

If a Republican like Trump is elected, a further regulatory pullback on EVs is expected. That could bring weaker emissions reduction targets, challenge the ability of California and other states to enforce gas- and diesel-powered new-vehicle sale bans by 2035, and potentially limit or end access to current federal incentives for plug-in vehicles.

The threat of Chinese competition has become a point of emphasis in recent weeks — a reality exacerbated by a report that BYD Auto Co. Ltd. is looking to open a plant in Mexico, a country with which the U.S. doesn’t have tariffs on vehicles that meet certain North American component requirements. The BYD Seagull city car in China sells for around the equivalent of $11,000, which even with import duties would be at a competitive price point, though most Americans prefer larger vehicles.

With automakers competing globally and in markets like China and Europe where vehicle emissions rules are more aggressive than in the U.S., no matter the election outcome, they’re still going to have to invest in EVs and compete with the Chinese, Riddell noted. Under a more aggressive regulation scheme, if domestic manufacturers are unable to hit cost reduction goals, he sees two potential unintended consequences: Consumers could be pushed into the used market, and it could create a greater opening for the Chinese.

Tesla Inc. has said it will launch a $25,000 EV, with CEO Elon Musk suggesting it could happen as early as 2025. Ford is developing a low-cost EV platform that could support vehicles costing as little as $25,000, though hasn’t specified an expected launch timeline. Stellantis’ Citroën ë-C3 hatchback in Europe starts at less than $22,000 (19,990 euro), and CEO Carlos Tavares has said the company is pursuing an affordable EV option appropriate for the U.S. marketplace.