Editorial: Legalized sports betting has grown in Oregon, is that good?

Published 5:00 am Friday, August 30, 2024

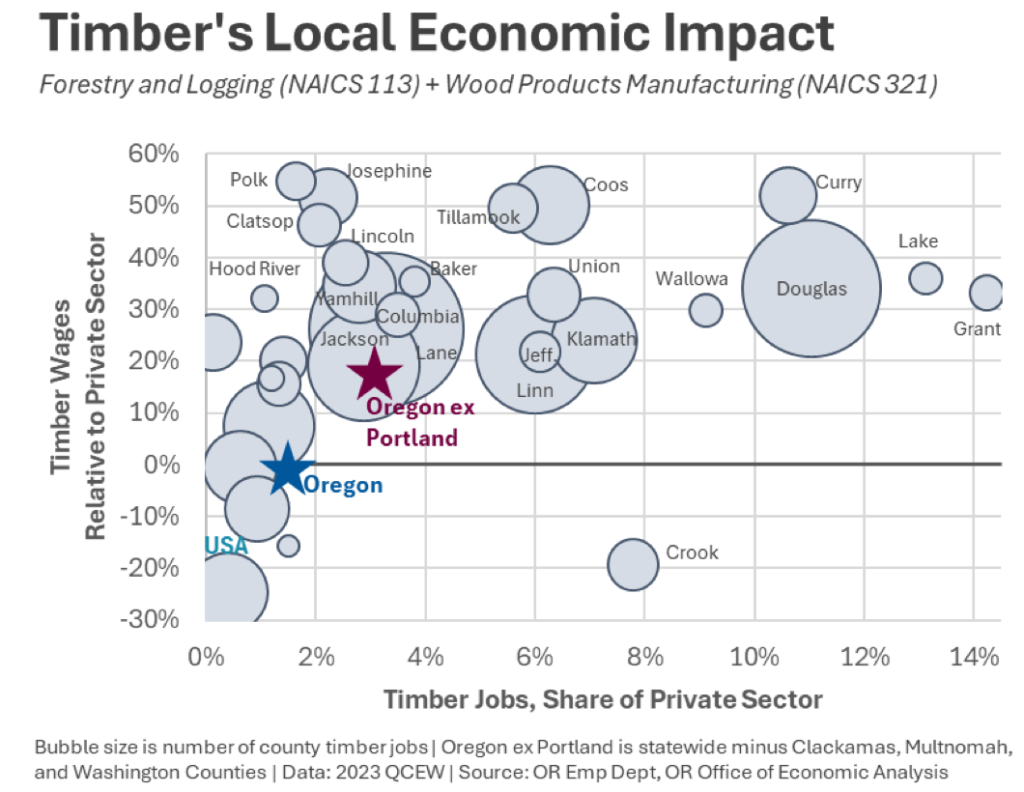

- The wood products industry is very important to many rural Oregon counties.

The big news out of Oregon’s latest government revenue forecast was the money Oregonians may get back via kicker and the added revenue legislators may have to spend.

Oregonians may get a personal rebate of about $987 million returned to them in 2026. And legislators may have about $676 million more in revenue to work with than anticipated.

Trending

But we’d like to draw your attention to three less-big news items in the latest Oregon forecast — a worrisome suggestion about sports betting, the relatively unusual importance of wood products, and a feature of the state’s psilocybin tax.

Sports betting

Revenue from sports betting is continuing to grow in Oregon. The revenue growth is good for all the many things it helps fund in Oregon. And it’s good that it’s legalized and there’s more attention on encouraging people to gamble responsibly.

Gambling, though, comes with a cost. More revenue for the state means more losing bets, more bettors, or it may be higher margins from the bets themselves.

New research actually suggests that vulnerable households may be gambling away their financial stability with online sports betting. If sports betting just replaces other types of gambling, maybe there is no new, real cost to Oregon’s legalization. But if there is something distinctly negative about how sports betting (now much easier and more addictive with smartphones at our fingers 24/7) displaces household spending, then Oregon may have little room to celebrate its winnings.

One study finds that sports betting and related purchases can “drive an increase in financial instability in terms of decreased credit availability, increased credit card debt and a higher incidence of overdrawing bank accounts.” And the research found that when people increase sports betting they don’t decrease “participation in lotteries or other online gambling.”

Trending

It’s one study, of course. It means, though, that sports betting may not be as much of an ace in the hole as it is a way that may encourage some people to go bust.

Wood products

Oregon’s wood products manufacturing was more a part of the state’s past than its present. Still, Oregon’s manufacturing sector and the jobs in Oregon’s rural counties are much more tilted toward wood products than other states. Outside of Portland, the industry makes up 3% of all jobs in Oregon. That is a much higher percentage than other states. The average wage in the timber industry is also 17% “higher compared to the local private sector wage” outside of Portland. The timber industry still very much matters in Oregon, especially in rural areas.

Psilocybin taxes

The psilocybin industry is just getting started in Oregon. But we’d like to point out something we have pointed out before. It has to do with the way psilocybin is taxed. The state tax is a 15% retail sales tax on the product used. The price of the product may be $40. The overall price of the session, however, can be hundreds or even thousands of dollars. Is that the right way for Oregon to tax the industry? If the tax is sufficient to cover the expenses of regulating the industry as is, maybe it’s just fine. Or maybe a lot of the industry is operating untaxed.

You can find the surprisingly interesting revenue forecast here: tinyurl.com/OR924forecast.