Twins reignite Facebook battle

Published 4:00 am Friday, December 31, 2010

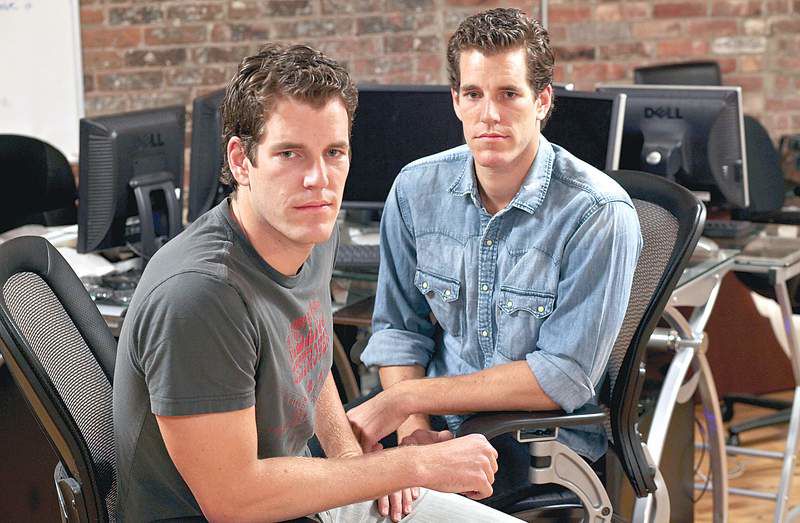

- Twin brothers Tyler, left, and Cameron Winklevoss sued Facebook and Mark Zuckerberg in 2004, claiming that they, along with another Harvard student, Divya Narendra, had the original idea for Facebook. The Winklevosses want to undo that $65 million deal and pursue a new case against Facebook.

SAN DIEGO — Some people go to court hoping to win millions of dollars. Tyler and Cameron Winklevoss have already won tens of millions. But six years into a legal feud with Facebook, they want to give it back — for a chance to get more.

The Winklevosses — identical twins and Harvard graduates — say that they, along with another Harvard student, Divya Narendra, had the original idea for Facebook and that Mark Zuckerberg stole it. They sued Facebook and Zuckerberg in 2004, settling four years later for $20 million in cash and $45 million in Facebook shares.

They have been trying to undo that settlement since, saying they were misled on the value of the deal. But the decision has not been easy.

As recently as Thursday, the brothers considered dropping their effort to unwind the agreement and went as far as drafting a statement to that effect, according to people close to the case. They decided, though, to keep fighting. Their argument is that Facebook deceived them about the value of the shares, leaving them with far less than they had agreed to.

Whatever their value at the time of the deal, Facebook’s shares have soared since, putting the current worth of the settlement, by some estimates, at more than $140 million.

Next month, the twins and Narendra plan to ask a federal appeals court in San Francisco to undo the deal so they can pursue their original case against Facebook and Zuckerberg, and win a richer payday. They could, though, lose it all.

Still, they say it’s not about the money, it’s about the principle — and vindication.

“The principle is that they didn’t fight fair,” said Tyler Winklevoss during an interview at a pub here recently. “The principle is that Mark stole the idea.”

His brother, Cameron, chimed in, “What we agreed to is not what we got.”

Facebook denies it did anything improper and says the Winklevosses simply suffer from a case of “settlers’ remorse.”

To make matters more complicated, the twins are also at war with the lawyers who helped them win the settlement. The brothers fired them, accused them of malpractice and refused to pay them. A judge recently found for the lawyers and ordered the twins to pay the 20 percent contingency fee, or $13 million. For now, the money and shares remain in an escrow account.

Riled up

Yet their battle with Zuckerberg is what has had them riled up. When they talked about him, and told their version of the founding of Facebook, they helped finish each other’s sentences, easily reciting every last detail of a tale they have evidently told time and again.

“It shouldn’t be that Mark Zuckerberg gets away with behaving that way,” Cameron Winklevoss said.

The company declined to make Zuckerberg available for an interview, and Andrew Noyes, a spokesman, said that Facebook would have no comment “beyond what is already in our appellate briefs.” In the past, Zuckerberg has denied he stole the Facebook idea from the Winklevosses, saying they planned a dating site, not a social network.

As the twins talked about the Facebook case, no detail was too small to omit, from where they first met Zuckerberg (the Kirkland House dining room) to the layout of Zuckerberg’s dorm room, to the content of the e-mails he had sent them after they asked him to do computer programming for a website called Harvard Connection. They recited arcane facts about the valuation of private companies and even quoted from the Securities Act of 1934, which they say Facebook violated when it drew up the settlement.

In addition to a bigger payday, the twins say they want a court to reconsider their original claims about Facebook’s founding, pointing to instant messages on the subject sent by Zuckerberg to friends. The messages have come to light since the brothers signed the deal. But they say Facebook executives and board members have known about the messages since 2006 and played dirty by concealing them when they negotiated the settlement.

“If you take all those documents, it is a dramatically different picture,” Tyler Winklevoss said.

Facebook declined to comment on the messages. In prior interviews, Zuckerberg said he had regretted sending some of them.

High-risk case

While the Winklevosses could end up losing their settlement, the risks for Facebook are high as well. If the court unwinds the agreement, the company will have to decide whether to offer them a richer settlement or face a trial. Recent trades on a private exchange suggest that Facebook, which is not a public company, now is worth around $50 billion, and the company may not want the negative publicity associated with a trial, especially if it decides to move forward with a stock offering.

The roots of the original dispute date to 2003, when Zuckerberg, then a Harvard sophomore, said he would help the Winklevosses and Narendra program Harvard Connection, later renamed ConnectU. But Zuckerberg delayed work on Harvard Connection and, when pressed for answers, stalled, according to the Winklevosses. In February 2004 he released TheFacebook, which eventually became Facebook.

After ConnectU and its founders sued, Facebook countersued in 2005.

The settlement, which gave Facebook ownership of Connect-U, was supposed to resolve all claims.

The details of the new dispute, which erupted almost immediately, are less known, in part because the parties reached the settlement after a confidential mediation. But according to court documents, the parties agreed to settle for a sum of $65 million. The Winklevosses then asked whether they could receive part of it in Facebook shares and proposed a price of $35.90 for each share, based on an investment Microsoft made nearly five months earlier that pegged Facebook’s total value at $15 billion. Under that valuation, they received 1.25 million shares, putting the stock portion of the agreement at $45 million.

Yet days before the settlement, Facebook’s board signed off on an expert’s valuation that put a price of $8.88 on its shares. Facebook did not disclose that valuation, which would have given the shares a worth of $11 million. The ConnectU founders contend that Facebook’s omission was deceptive and amounted to securities fraud.

They refuse to say how much they would ask for in a new negotiation, but they said that based on the lower valuation, they should have received roughly four times the number of shares. At today’s price, that would give the settlement a value of more than $500 million.

In its brief, the company says it was under no obligation to disclose the $8.88 valuation, which was available in public filings. Facebook describes it as one of many that it received and as “immaterial” to the calculations of ConnectU founders and their battery of lawyers and advisers.

“There was no chance that that one valuation would have affected the decision of these sophisticated investors and their entourage of advisers,” Facebook wrote in its brief.