Central Oregon transit tax

Published 5:00 am Thursday, September 9, 2010

- Central Oregon transit tax

If Central Oregonians aren’t willing to pay more taxes, dreams of a regional transit system with coordinated services in Bend, Redmond, La Pine and other outlying areas could be short-lived.

The Central Oregon Intergovernmental Council, which operates Cascades East Transit, took over Bend Area Transit from the city on Sept. 1, and officials have said that for the merger to be successful a transportation district with a sustainable funding source needs to be created.

While there are several ways to fund a transportation district — including through a sales tax — the only two methods used by other districts in the state are payroll and property taxes.

But before officials go to voters asking them for more money, Bend City Manager Eric King said the next several years will be spent making sure the BAT and CET merger works and is something that could be sold at the ballot boxes as worthwhile.

“It’s going to take awhile for that to occur,” King said. “We have to give it time to focus on this merger and make sure it’s effective and there’s no issue from an operational perspective. That’s what we’re focused on in the short term.”

The city, which is facing a six-year, $17 million shortfall in its general fund, really wants BAT out of its budget. In fiscal year 2009-10, $1.1 million of its general fund dollars, which are used to pay for services like public safety, went to the transit service.

But attempts to get voters to shoulder the burden of BAT’s costs have failed at least two times before, in 2004 and 2008, and those defeats seem to be making officials take a measured approach for forming a regional transit district.

Funding sources

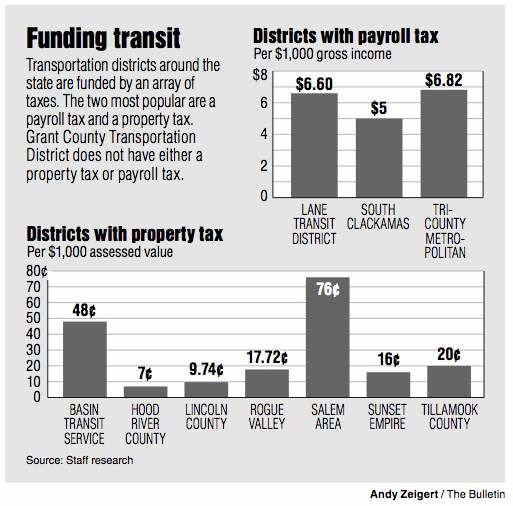

Of the 11 transit districts in the state, all but one relies on payroll or property taxes. The one that doesn’t, Grant County Transportation District, only has four buses and doesn’t use a local tax to help pay its costs.

Most districts in the state use some form of a property tax, with the highest rate coming from Salem Area Mass Transit at $0.76 per $1,000 of assessed value, which adds up to $152 for a $200,000 home. The lowest rate is in Hood River, where property owners are charged $0.07 per $1,000 of assessed value, or $14 for a $200,000 home.

Only three transit districts get payroll taxes from individuals inside their districts. Those include the Lane Transit District in Eugene, South Clackamas Transportation District in Molalla and the Tri-County Metropolitan Transportation District (TriMet) in Portland. TriMet has the highest tax rate at $6.82 per $1,000 of gross income and South Clackamas has the lowest at $5 per $1,000.

While it’s still too early to know whether local officials will pursue payroll or property taxes — or something completely different — transit district managers from around the state said there are several considerations that need to be made.

Steve Dickey, the director of transportation development for Salem’s district, said the amount of payroll and property taxes transportation agencies received has suffered from the downturn in the economy. When times are good, he said property tax revenues don’t increase as quickly as payroll taxes.

But the other consideration that needs to be made, he said, is for the taxpayers.

What about taxpayers?

A payroll tax can result in backlash from the business community, and property tax increases can always be difficult for residents to swallow.

“What I think makes more sense is maybe a split between the two but at a lower rate,” Dickey said. “Everybody shares a little bit and nobody carries the full load. … Don’t box them in because that really hurts.”

The down economy might be the biggest hurdle for the region to overcome before asking voters to approve more taxes to pay for a transit service.

Shirley Lyons, the manager of South Clackamas Transportation District, said that was one of the things she had to overcome in Molalla, which had been hit by the decline in the timber industry.

She said the first attempt to get voters to approve a payroll tax failed by a slim margin. And the second time around required some campaigning to get residents to approve a new tax.

In Central Oregon, where the economy was hit hard by the recent recession, especially in housing, she said, local officials will probably face some of the same challenges as the South Clackamas Transportation District.

“I wish them well,” she said. “But I’m glad to be paddling my own canoe here.”