More local homeowners pull back from foreclosure

Published 5:00 am Friday, October 9, 2009

- More local homeowners pull back from foreclosure

Lenders are stopping an increasing number of the foreclosure proceedings they initiated in Deschutes County, but it is unclear whether homeowners are getting more help through loan modifications.

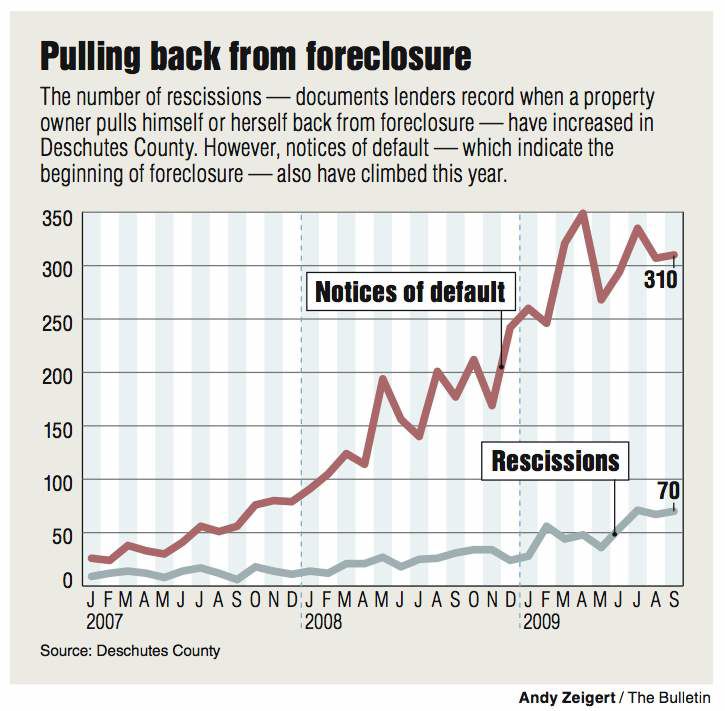

At the same time, the number of notices of default in Deschutes County remains high. A notice of default begins foreclosure proceedings, but not all properties that receive notices of default are repossessed by banks. The county recorded 2,687 notices of default in the first nine months of 2009, compared with 1,305 notices of default in the same period in 2008, an increase of 106 percent.

From January through September, the County Clerk’s Office had recorded documents showing that for every property pulled back from foreclosure through what is known as a “rescission,” there were approximately 5.7 new notices of default.

That was down from the same period in 2008, when there were 6.7 notices of default recorded for every rescission.

The Bulletin contacted some of the people whose properties were recently pulled back from foreclosure through rescissions to find out whether this meant they were able to obtain home loan modifications. Those who responded described a range of scenarios.

A few said they avoided foreclosure by selling their properties in short sales, in which the owner sells the property for less than is owed on the mortgage or mortgages.

When an offer is made, the lender conducts a market analysis to determine the property value and then decides whether to accept the offer.

Two property owners who received rescissions stopping the foreclosure process said they were still struggling to obtain home loan modifications after seeking them for months.

“I was trying to do a loan modification because of changes in my employment,” said Bobbi Jo Blood, 52, who lives near Alfalfa and started her own landscape maintenance business after she noticed the company she used to work for was faring badly in the recession. “And I thought if I could lower my interest rate, that would be great, because over the long run, that’s a significant amount (of money saved),” Blood said. “I’ve been (trying to get a modification) since January.”

Blood said her bank probably stopped the foreclosure on her home after she paid several months of late mortgage payments in August. As of Thursday night, she had not received a loan modification but planned to send in paperwork applying for one today.

The Obama administration said Thursday that its much-criticized program to help homeowners avoid foreclosure had met its initial target of 500,000 trial mortgage modifications about a month ahead of schedule, touting the news as a sign the effort is gaining momentum. The $75 billion program, announced in February, was designed to ease foreclosures by helping struggling homeowners modify their mortgages through refinancing, reduced principal or longer payment terms.

But the program was slow in getting started, so the administration has been refining it. This spring, it added cash incentives for borrowers and lenders who participate. And in July, Treasury Secretary Timothy Geithner and Housing and Urban Development Secretary Shaun Donovan pushed the chief executives of mortgage servicers to increase staff, streamline application procedures and improve their customer response.

Laura Fritz, housing center manager at NeighborImpact, said recently she did not know whether the increase in rescissions means more people are successfully modifying their home loans.

“At the same time, we’re helping people get modifications,” Fritz said. “They are happening, so some people are able to rearrange their loans so it’s manageable.”

Dave Woodland, senior vice president of Signet Mortgage Corp., said he has limited experience with home loan modifications but knows someone who successfully completed one.

“I know of a gentleman in town who completed a modification recently, and his experience was that he had to be very persistent on his own part as he kept running into road blocks.”

Frank Wheeler, executive vice president of Bank of the Cascades, said the bank usually initiates home loan modifications before the owners receive a notice of default and enter foreclosure. The number of rescissions would not reflect these homeowners, since they never entered foreclosure and would not need to be pulled back from it. Bank of the Cascades sells its mortgages to housing finance agency Fannie Mae but continues serving them itself.

“Modifications are not really increasing and frankly, at least in our portfolio, default is not necessarily indicative of modification,” Wheeler said. “The vast majority of modifications so far are not people that are in foreclosure, just people having severe financial hardships of one sort or another.”