Intel slumps as muted outlook highlights AI gap with rivals Nvidia and AMD

Published 4:57 am Friday, January 26, 2024

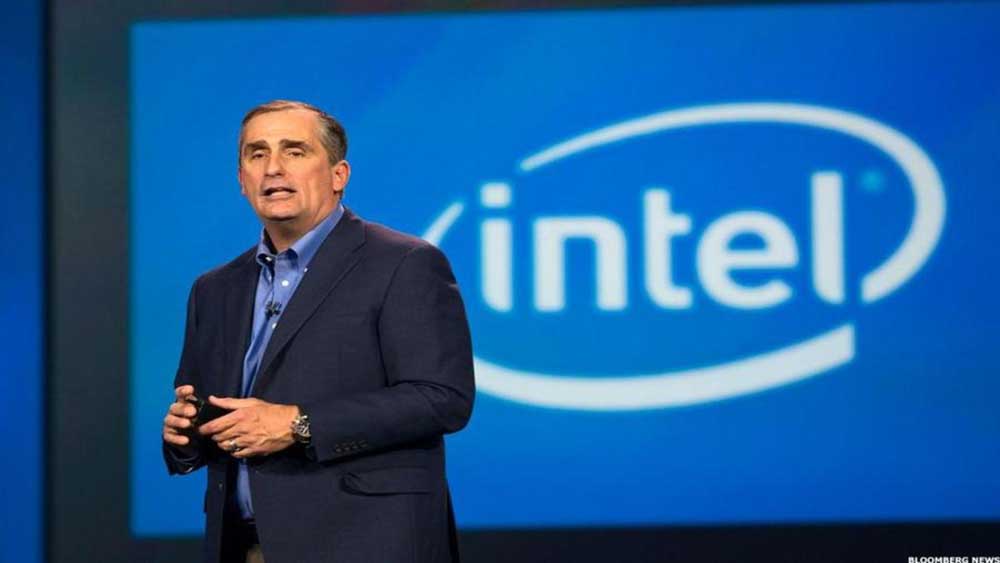

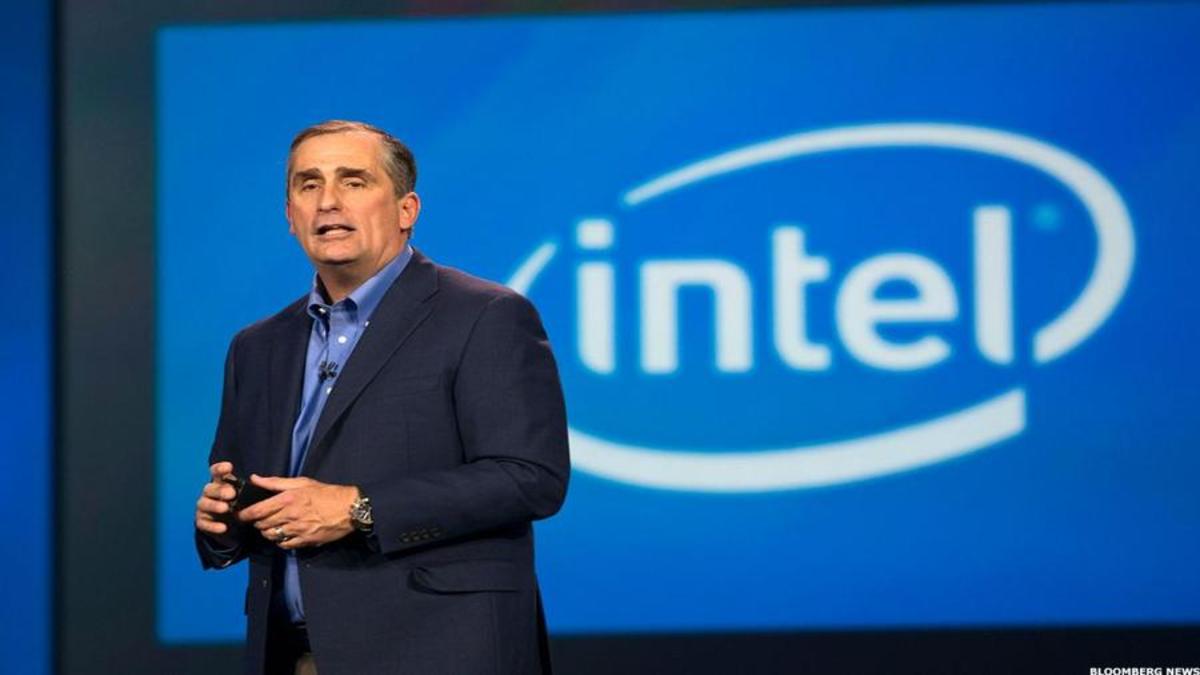

- Intel CEO Pat Gelsinger says Intel will bring "AI everywhere across our product segments."

Intel (INTC) – Get Free Report shares moved sharply lower in early Friday trading after the chipmaker cautioned that slumping demand for its PC and server chips would clip near-term sales, clouding a stronger-than-expected fourth-quarter earnings update.

Intel, which is deep into a turnaround under CEO Pat Gelsinger aimed at simplifying its corporate structure and raising capital to expand foundries, focuses on traditional chip sectors such as PCs and legacy servers for the bulk of its sales.

Related: Microsoft passes $3 trillion benchmark as AI hype powers stock to record

In some ways that leaves it vulnerable to the surge in investment in AI-focused technologies, which require specialized graphics-processing units and data servers from rivals such as Nvidia (NVDA) – Get Free Report and Advanced Micro Devices (AMD) – Get Free Report.

That investment drive has resulted in lower capital spending left over for companies to devote to legacy tech infrastructures, where Intel remains the market leader.

Intel and AMD are also testing that leadership, however, by using technology from Arm Holdings, the U.K. chipmaker that listed on the Nasdaq last year, to design central-processing units that will run the Microsoft (MSFT) – Get Free Report operating system.

AMD is also set to use Arm’s technology to design CPUs for Windows-based PCs.

Reuters reported last fall that both companies could begin selling the chips as early as 2025. That would amount to a major challenge to Intel’s fading market dominance, which was hit by Microsoft’s decision to start using Qualcomm (QCOM) – Get Free Report chips in 2016.

Intel: Data centers off, client computing up

Intel’s fourth-quarter 2023 data-center revenue, in fact, fell 10% from the year-earlier period to around $4 billion, while networking revenue was off 24% at just $1.5 billion.

That was partly offset by a stronger haul for Intel’s client-computing group, its largest revenue generator, which saw sales rise 33% to $8.8 billion.

Overall revenue was $15.4 billion, just ahead of Wall Street forecasts, while the group’s adjusted profit rose to 54 cents a share, topping the consensus analyst estimate by a dime.

Looking into the current quarter, however, Intel sees both a slowdown in sales, with revenue in the region of $12.2 billion to $13.2 billion, with profit of around 13 cents a share. Both tallies were well shy of Wall Street forecasts.

When he spoke with investors late Thursday, Gelsinger noted what he called “discrete headwinds” to the group’s near-term outlook. These include muted guidance from Mobileye, the Israel-based self-driving company in which Intel has a controlling stake, as well as other “business exits.”

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it’s not Nvidia!)

“Importantly, we see this as temporary, and we expect sequential and year-on-year growth in both revenue and EPS for each quarter of fiscal year ’24,” he added. “Momentum and excitement around new products and businesses remain strong as we head into the year and will grow stronger as the year progresses.”

He also vowed to “execute on our mission to bring AI everywhere across our product segments.”

Analysts: Intel must step up AI effort

However, analysts say Intel needs to step up its effort to compete in AI in order to capture investor attention, particularly as companies look to shift spending from large-language-model training to customer-focused applications.

“The rapid adoption of AI by all industries is proving to be a significant tailwind for (the group’s foundry business) as high-performance compute, an area where we have considerable wafer and packaging know-how and [intellectual property], is now one of the largest and fastest-growing segments of the semiconductor market,” Gelsinger said.

Intel shares were marked 10.1% lower in premarket trading to indicate a Friday opening bell price of $44.57 each, a move that would trim the stock’s six-month gain to around 29%.

“While Intel’s disappointing guidance is likely to curtail the positive momentum Intel’s shares have enjoyed recently, we believe investors should use any significant weakness as an opportunity to build positions,” said Benchmark analyst Cody Acree.

Acree, who carries a buy rating with a $62 price target on the stock, said investors should “take advantage of a stock pullback, while gaining leverage to the company’s significant improvements in its design competitiveness, the stabilizing health of its core PC business, its AI PC opportunity.”

Related: Veteran fund manager picks favorite stocks for 2024