Optimism and caution in Bernanke testimony

Published 4:00 am Wednesday, March 2, 2011

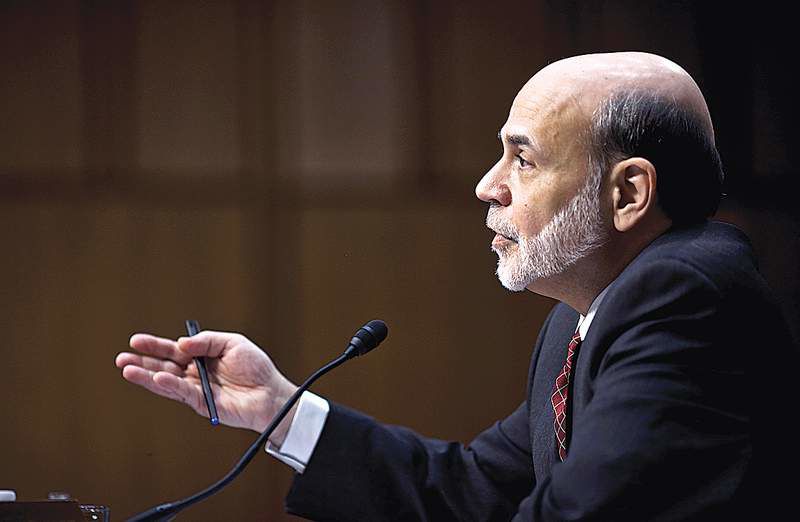

- Federal Reserve Chairman Ben Bernanke testifies Wednesday before the Senate Banking Committee on Capitol Hill in Washington.

WASHINGTON — Oil prices are rising. Housing prices are falling. But the Federal Reserve chairman, Ben Bernanke, told Congress on Tuesday that neither issue was likely to derail renewed growth.

There is growing confidence among policymakers here that the economy is making headway, and that Americans still suffering the lingering effects of the 2008 financial crisis will soon start to feel the benefits.

“We have seen increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” Bernanke said in testimony before the Senate Banking Committee. He added, however, that “until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established.”

The remarks by Bernanke, which have been echoed by other officials, place the central bank chairman in the position of telling Americans that things are better than they seem. The Obama administration, privately optimistic but publicly committed to sympathizing when it talks about the economy, said last week that growth is “not happening fast enough.”

Bernanke also finds himself on a political tightrope. The Fed is engaged in a vast and unprecedented effort to stimulate growth by buying hundreds of billions of dollars in federal debt, helping to hold down the cost of borrowing.

Republicans worry that the Fed is overstimulating the economy, and they see evidence in the signs of growth that it is time to start fighting inflation by cutting back.

“Once price stability has been lost, it’s difficult and very costly to regain,” Sen. Richard Shelby, R-Ala., said Tuesday, invoking the 1980s.