Montana bank acquires Bank of the Cascades

Published 7:53 pm Wednesday, May 31, 2017

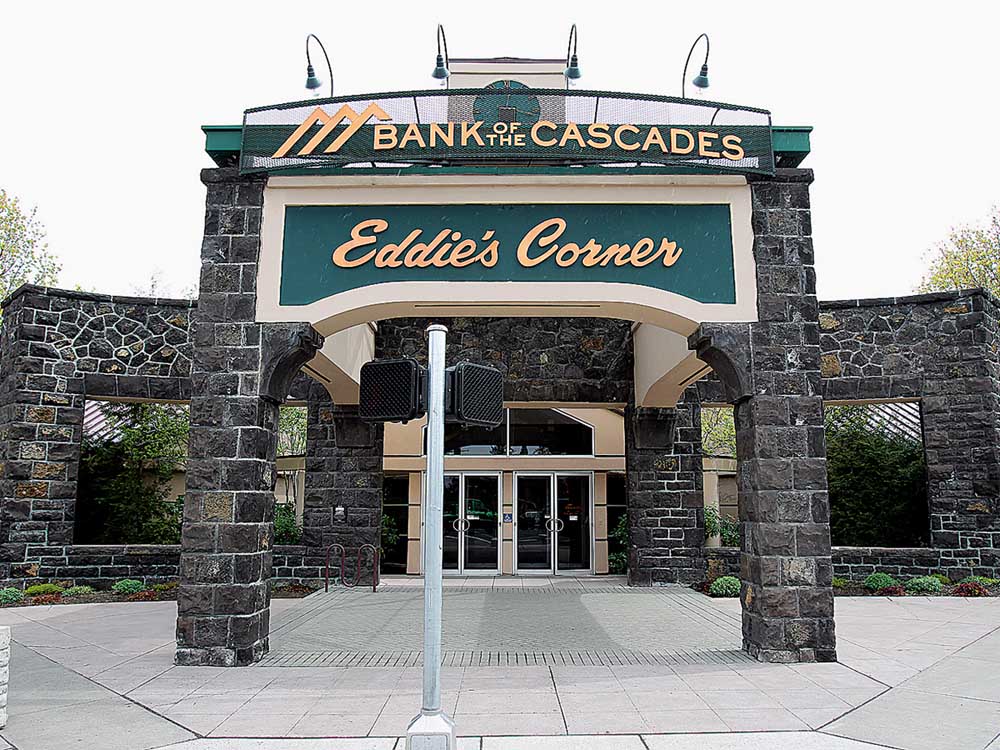

- First Interstate Bank completed its acquisition Tuesday of Bend-based Bank of the Cascades. (Andy Tullis/ Bulletin file photo)

It’s official: Bend-based Bank of the Cascades is owned by First Interstate Bank of Billings, Montana.

The deal’s closing Tuesday means any Bank of the Cascades shareholders who hung onto the stock will now own shares in First Interstate. Customers won’t see changes until the middle of August, when First Interstate begins transferring data and changes signs and other materials. All Bank of the Cascades branches in Washington, Idaho and Oregon will change to First Interstate.

Trending

First Interstate CEO Kevin Riley said Bank of the Cascades will operate as usual until Aug. 14, when the corporate identities will change. First Interstate has posted on the Bank of the Cascades website a document with answers to frequently asked questions.

In keeping with terms of the deal, which was announced after markets closed Nov. 17, First Interstate issued 11.3 million shares of Class A common stock and paid $156.3 million in cash to shareholders of Bank of the Cascades’ holding company, Cascade Bancorp, according to a press release by First Interstate. Tuesday was the last day of trading for Cascade Bancorp, which closed at $6.99, according to the Nasdaq Stock Market.

The two banks’ stocks gained value after the merger was announced in November, but the short-term gains didn’t last, said Ralph Cole, executive vice president of research and strategy at Ferguson Wellman Capital Management in Portland. The firm does not invest in either bank.

Regional bank stocks in general have seen a sell-off since the first of the year as investors realized President Donald Trump’s promise of lower taxes and higher spending might not come to fruition in 2017, and 10-year Treasury rates have fallen, Cole said. Investors had expected interest rates to rise, making banks more profitable, he said.

As a result, Bank of the Cascades’ shareholders now own a stock that’s down 10.6 percent since the merger was announced Nov. 17. First Interstate shares closed that day at $38.40, according to the Nasdaq, and they closed Tuesday at $34.30.

Each share of Bank of the Cascades stock was exchanged for 0.14864 shares of First Interstate stock and $1.91 in cash. So someone who owned 100 shares of Bank of the Cascades received 14 shares of First Interstate, plus about $191.

Trending

Bank of the Cascades’ shareholders would have done well to sell during the run-up that occurred between the banks announcing the deal and the end of the first quarter, Cole said.

The stock reached a recent high of $8.42 on Feb. 24. For those who have hung on through the deal’s closing, he said, “Now it’s a whole new entity you have to analyze and decide on.”

Riley said the recent decline in stock price reflects the end of the so-called “Trump bump,” and First Interstate shareholders should look for results over the long run. “We want our shareholders to get a long-term, steady return,” he said.

The deal’s closing also means several Bank of the Cascades executives have retired, Riley said, including CEO Terry Zink and Chief Financial Officer Greg Newton. First Interstate had wanted Chief Operating Officer Chip Reeves to stay with the merged bank, but Riley said Reeves also departed, and First Interstate expects to name someone else as chief banking officer for the Northwest region, based in Bend. In the meantime, he said, Central Oregon will be overseen by regional President Julie Miller in Bend.

“Most customer-facing employees will be left intact even after the conversion,” Riley said.

— Reporter: 541-617-7860, kmclaughlin@bendbulletin.com