$18M in debt, filing bankruptcy

Published 4:00 am Saturday, January 1, 2011

- $18M in debt, filing bankruptcy

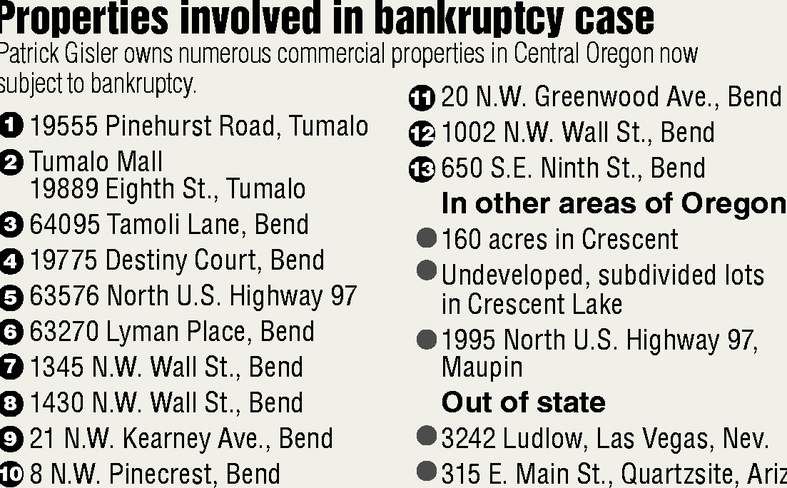

A once controversial area businessman who owns about $6 million in real estate throughout Central Oregon has filed for bankruptcy in a case that involves “one of the largest” Deschutes County property tax delinquencies in recent memory.

Federal court documents show Patrick Gisler has about $18 million in outstanding debt including loans for commercial properties in downtown Bend and Tumalo. In the documents, Gisler also lists about $8 million in assets.

Gisler’s petition was originally filed in Las Vegas in January, but Bank of the Cascades and Home Federal Bank have had the case moved to Oregon, according to a document showing that nearly $13 million of that debt is owed to Oregon creditors, including the Deschutes County Assessor.

Gisler, 64, said Wednesday the bankruptcy was primarily brought on because he has reduced commercial rents in recent years to keep his tenants, who are mainly small-business owners.

“I have accommodated them rent-wise and that really led to the problems because I didn’t think it was good business to let them bleed to death and be gone,” Gisler said. “So even though the rents declined below the level that would sustain the operations of the buildings, I have done my best to keep the buildings in operation.”

Gisler said he “deferred the property taxes” on his buildings so that he could make the payments, and has appealed the amount of taxes assessed. But county records show he now owes nearly $300,000 in back taxes, an amount Deschutes County Deputy Tax Collector Dave Lilley called “one of the largest I’ve seen” in his 12 years on the job.

Nearly $60,000 of that tax debt is related to the Old Penny Galleria in the 1000 block of Wall Street in downtown Bend.

Roberta Johnson, owner of Sports Vision Bend, said she has been a tenant in that building since 1989 and that Gisler has given her breaks on rent, including an unexpected one-third reduction in December.

“He didn’t say a thing, he just took it off the bill. I didn’t even have to ask,” Johnson said.

Gisler said he was driven to help his 150 tenants in various locations “survive the challenges of these times.”

But Gisler, who owns Oregon Lifestyles Realty and is the CEO of a Colorado-based oil and gas exploration company, may not survive financially himself. He now owes debts to about two dozen creditors for real estate as well as property including a private plane, a boat, several cars, a $12,000 irrigation system and a tractor.

A local history

Gisler’s family has lived in Central Oregon for decades and developed more than 1,000 acres from La Pine to Redmond. The family also discovered a freshwater well in La Pine that now bears the Gisler name, according to Bulletin archives.

But in the late ’90s, Gisler stirred controversy in Bend when he bought a former Moose Lodge building near the Bend Parkway that he rented to a strip club. The building was later burned by the club’s owner in an arson.

In 2000, Gisler was part of a movement to develop Bend’s northeast side, resulting in a master plan covering about 700 acres in the area of 18th Street and Cooley Road where housing developments now sit.

A year later, Gisler and his brother gave the city of Bend a 12-acre plot near the corner of Empire Avenue and Purcell Boulevard along with $25,000 to maintain the land as a park and open space.

The family, which owns property in the Tumalo area, tried to make their presence in Central Oregon more permanently known when they made a failed bid to have a road in the area named “Gisler Trail.”

More recently, Gisler’s financial troubles have resulted in civil lawsuits filed in Deschutes County Circuit Court alleging he had failed to repay loans to both banks and private individuals.

Last year, a lien was placed on a home Gisler owns in Tumalo when a tenant there failed to pay the water bill. Earlier this year Gisler said he was fighting the district’s lien, in part because it wanted to charge him $3,000 for its attorney fees.

The bankruptcy

Gisler said Wednesday he considered what to do for several months before filing bankruptcy. He has filed under a section of the code that allows him to enter into negotiations with lenders about how to pay the debts, not discharge them outright.

“We’re going to restructure the debts and each of those loans will be renegotiated with the lender,” Gisler said.

Gisler also will have to pay in full the back taxes he owes to Deschutes County or the properties will be foreclosed on, said Lilley, the deputy tax collector. The county can foreclose when the taxes owed are three years past due, though the bankruptcy process puts the possibility of foreclosure on hold.

“We are precluded from foreclosing while the properties are in bankruptcy,” Lilley said. “And clearly it can delay the collection of the taxes but it won’t affect the ultimate outcome.”

He said Gisler’s biggest past-due tax debt, about $151,000 on a building in the 1300 block of northwest Wall, is about a year past due.

Gisler said he anticipates paying off his debts but does not expect to sell property to make that happen. Gisler said he has tried to sell properties in recent years but commercial investors aren’t buying in this economy.

“We found that there is very limited or no financing for investor-owned buildings,” Gisler said. “There is limited financing for owner-occupants, but we don’t really have any occupants that are big enough to acquire those buildings.”

A hearing on Gisler’s bankruptcy case has been scheduled in federal bankruptcy court in Portland in June.