Managing a household without a bank account

Published 12:00 am Thursday, November 17, 2016

- Managing a household without a bank account

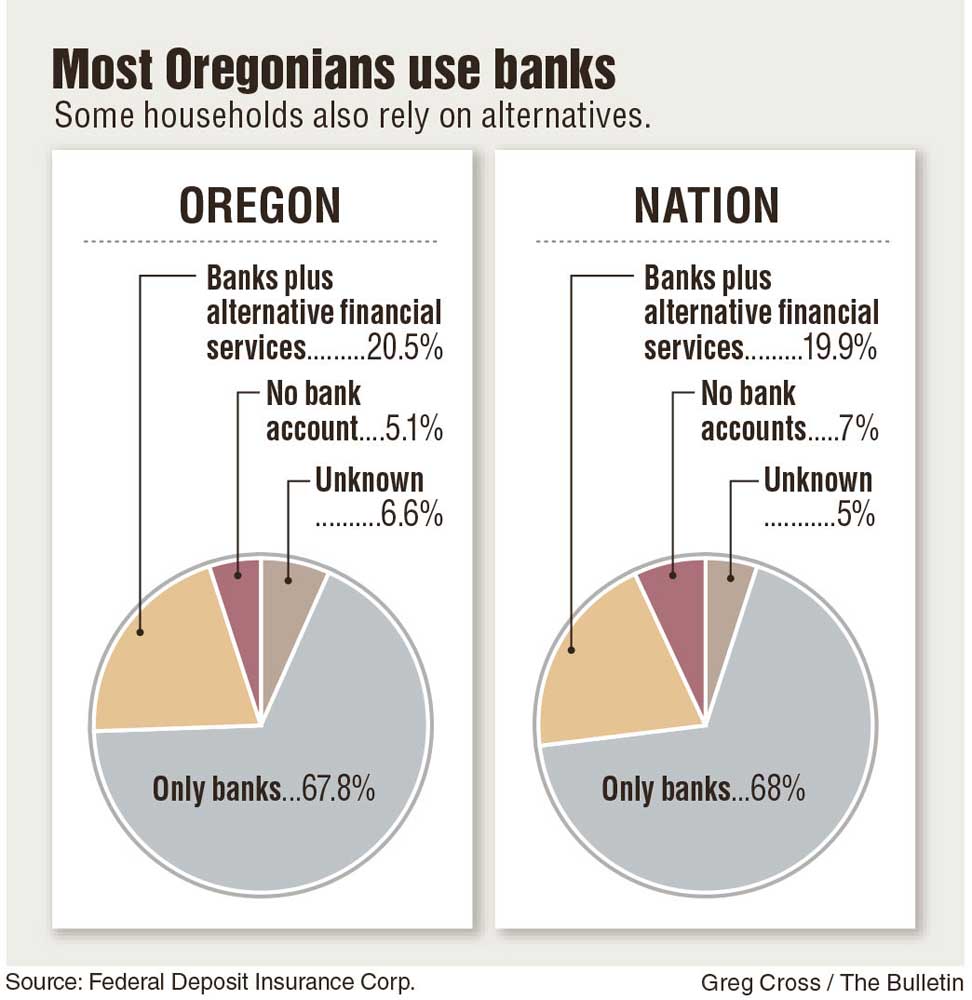

An improving economy led more Americans to use banks, rather than costly alternative financial services, in 2015, but a small portion of Oregon households still don’t have checking or savings accounts, according to a recently released survey by the Federal Deposit Insurance Corp.

The share of Oregon households lacking any bank relationship, which the FDIC and others refer to as “unbanked,” was 5.1 percent in 2015, according to the FDIC survey, which is conducted every two years. That was virtually unchanged from 2013, when the portion was 4.5 percent.

A larger, more significant group of Oregon households, 20.5 percent, has checking or savings accounts, but also used money orders, check-cashing services, payday loans or other alternatives to the regulated banking system in the past 12 months, the FDIC found. These households are called “underbanked.”

Nationwide, the rate of unbanked households fell from 7.7 percent to 7 percent, which is the lowest level since the survey began in 2009.

Oregon’s unbanked population is smaller than in most states, so it’s hard to get a read on the direction of the trend, an FDIC official said.

Some states, especially in the South, have unbanked populations in double digits.

“There’s still a group of people who never really bounced back,” said Lynne McConnell, deputy director of community services at NeighborImpact, a nonprofit in Redmond. Although Oregon’s economy is growing quickly, housing and other costs are leaving many households with less discretionary income than they had before the recession, she said.

Low-income households are more likely to be unbanked or underbanked, but they’re not the only ones, the FDIC found. The 2015 survey included a question for the first time about income volatility and found that even among households earning $50,000 to $75,000 a year, they were more likely to be unbanked or underbanked when their incomes varied “somewhat” or “a lot” from month to month. The FDIC is encouraging financial institutions to come up with products that can help people with variable income keep or set up accounts.

The FDIC also documented a rise in the use of prepaid cards, which may be marketed by financial institutions, or other companies, like Wal-Mart. Some card issuers report to the credit bureaus, so their products could be used to build one’s credit score, McConnell said.

Bank of the Cascades plans to offer its own prepaid card, which will be marketed to current account-holders and the broader community, sometime in 2017, said Debbie Amerongen, chief marketing officer.

The largest community bank in Oregon, Bank of the Cascades has offered a package of services suitable for the unbanked population for more than seven years, said Julie Miller, Oregon regional president. The package was developed under the Bank on Oregon initiative, she said, but for reasons that aren’t clear to bankers, people haven’t taken advantage of it.

“We have never opened an account, ever, under this program,” she said.

Bank on Oregon, a volunteer group of banks and credit unions, recently revived its effort to reach unbanked and underbanked households, Chairwoman Samantha Beeler said. The member institutions agree to offer consumer-friendly accounts, which typically can be opened with small amounts of money and have no minimum balance requirement.

The lack of banking relationships is especially common among rural Oregonians who don’t speak English, Beeler said. Bank on Oregon recently received a $10,000 grant that will be spent trying to figure out how to better market to rural residents.

Another question the FDIC added in its 2015 survey asked, “How interested are banks in serving households like yours?” Among the unbanked, 55.8 percent replied, “not at all.”

Beeler thinks that’s because of a lack of knowledge among the unbanked about the purpose of financial institutions, as well as historic prejudices.

“That’s why Bank on is so important,” Beeler said. “We want to let people know we are there for them.”

— Reporter: 541-617-7860, kmclaughlin@bendbulletin.com