ICYMI: Most broadband users still pay for television

Published 7:16 am Tuesday, January 24, 2017

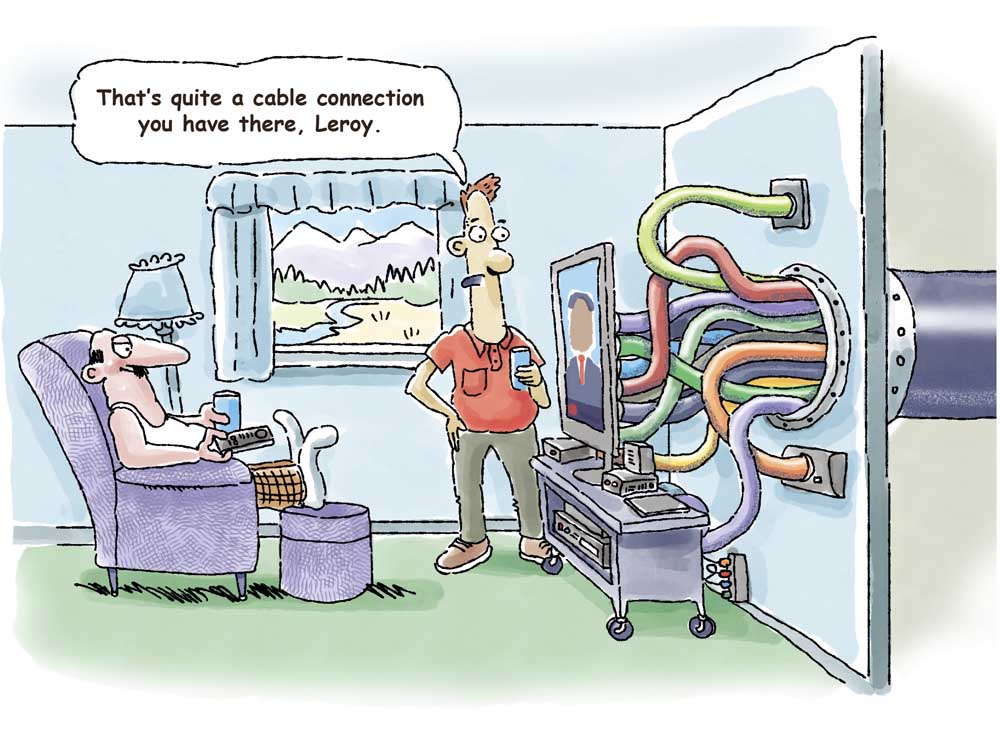

- (Greg Cross/Bulletin illustration)

A 37-year-old teacher, Ryan Kelling, of Bend, pays for DirecTV, broadband internet, two video-streaming services and an Amazon Prime membership, which includes streaming video.

He also uses the streaming app HBO Go, which he accesses with a family member’s password.

“I’m kind of a TV nerd,” Kelling said.

Fortunately for pay-television providers, Kelling is not alone in what the industry calls “over-the-top” video consumption. According to the market research firm Parks Associates, 81 percent of U.S. households that have broadband internet also pay for cable or satellite-based television. And about half of broadband households pay for television plus one or more streaming services.

But hanging onto those all-of-the-above subscribers is becoming more difficult for small companies such as BendBroadband, a subsidiary of TDS Telecom, said Brett Sappington, senior director of research at Parks.

All pay-television providers facing increasing costs for video content. Cable companies have shifted their focus to internet service, where they face competition from noncable technologies, such as digital subscriber lines, also known as DSL, and wireless.

Cable companies are making some interesting moves to keep up with the changes. Some, such as the former Cablevision, formed partnerships with streaming services like Hulu, so subscribers can include it in their bundles, Sappington said. “There’s a benefit there in making it easy to get that content,” he said.

BendBroadband in May announced it would waive data caps for subscribers who bundle their internet service with video or phone. The company declined to disclose what portion of its internet subscribers also pay for television, but at the time BendBroadband said more than half of its internet customers would benefit from the data-cap waiver. Speaking at a recent investor conference, Jane McCahon, senior vice president at TDS, said video is part of the “triple play” offering — internet, TV and phone service. As the cost of video content increases, TDS is concerned about how much it has to absorb.

“Our whole investment … is around broadband and the margins there,” McCahon said. “So we watch the video component very carefully to make sure that that’s still the right economics for the overall business.”

BendBroadband emphasizes internet speeds in its marketing and says it hopes to roll out 1-gigabit-per-second service in the next few years.

Mike O’Herron, a local cable-industry veteran and general manager of Crestview Cable in Prineville, said the whole cable industry expects that consumers will continue to make broadband internet service the top priority. “We’re internet service providers who happen to have these other products,” he said. So-called cord-cutters are still the minority, but their ranks are growing quickly.

About 53 million U.S. households subscribed to cable, and another 35 million subscribed to satellite service in third quarter 2016, according to Nielsen’s quarterly Total Audience Report.

The number of broadband internet-only households was 4.6 million, but it had grown by 27 percent from third quarter 2015, according to Nielsen. Also in 2016, the number of households using streaming video services drew even with digital video recorders, or DVR.

Streaming video stole Robin Judice’s heart four years ago, when she and her husband moved to Bend. They ditched their TV and cable subscription that went with it because they planned to spend a lot of time in their recreational vehicle.

Even after leaving the road, Judice found that Netflix and Amazon Prime covered most of their entertainment needs. The streaming pushed them against BendBroadband’s data caps, however, so they bought a bigger internet package. Judice pays $90 a month, plus $10 for equipment, for BendBroadband’s highest tier of internet service. Still, she won’t bite on any bundled offers.

“We just don’t need any of it,” said Judice, 53. “The needs for the live stuff are so slim that it’s just not worth the extra money.”

O’Herron said Netflix accounts for more than half the traffic on Crestview’s network, and he said that’s typical for internet providers. He complains that consumers embrace Netflix, which costs about $8 a month, as an affordable service, but they direct their complaints about service to the cable companies. “Everyone wants free transportation,” he said, referring to streaming services. “We say, ‘Why should you ride us for free?’”

Sappington points out, though, that cable companies wouldn’t be selling as much data as they do if it weren’t for the popularity of online video. “It’s an interesting conundrum,” he said. “Netflix giveth, and Netflix taketh away.”

— Reporter: 541-617-7860, kmclaughlin@bendbulletin.com

“Our whole investment … is around broadband and the margins there. So we watch the video component very carefully to make sure that that’s still the right economics for the overall business.”— Jane McCahon, senior vice president at TDS